Business

More News

-

GM fined record $35m over ignition recall delay

Penalty comes in wake of auto maker’s failure to report issue.

-

Stock markets: Govt unlikely to increase capital gains tax to 17.5%

May agree on a reduced rate, brokers will submit a workable proposal.

-

Weekly review: KSE-100 gains 389 points on MSCI upgrade

Volumes remained lacklustre as investors awaited monetary policy announcement.

-

In line with expectations: SBP keeps monetary policy rate unchanged

Will remain at 10% for 2 months, statement mainly recounts positive developments.

-

Apple, Google call truce in smartphone patent war

The companies made it clear that the detente does not include licensing their technology to each other.

-

Upswing: Energy remains our priority, Dar

Raphel also acknowledged that Pakistan was undergoing an upswing.

-

Diversification: Govt broadening export basket, says Afridi

Subsidy to be provided for date and olive processing.

-

Another proposal: Make jute mandatory packaging material, says PJMA

Will keep quality, germination capability intact.

-

Khyber-Pakhtunkhwa gets Rs17.8b in royalty

Oil, gas companies paid the amount for July-June 2012-13.

-

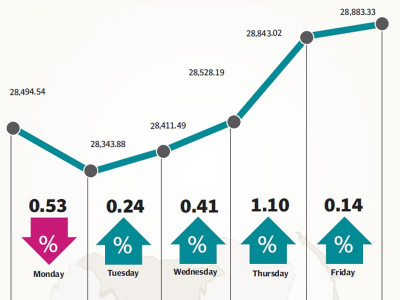

Market watch: Index continues positive momentum

Benchmark KSE-100 index gains 40 points.

-

Phenomenal growth: Auto industry’s profits up 52%

Rupee appreciation helped industry’s profitability.

-

Global Economic Conditions Survey: Business confidence in Pakistan at a three-year high

Survey says 43% of respondents reported confidence gain.

-

10MFY14: Govt likely to miss export target, PBS data shows

Exports fall 14.5% in April compared to March.

-

ECC huddle: Govt to borrow Rs31b to pay some circular debt

Committee approves Rs2b Ramazan relief package.

-

Exploration work: Govt considering stopping $40m financing for Mari Gas

Company’s gas price may go up as it could be linked with crude oil.

-

Upcoming budget: Ambitious govt hopes to achieve 5.1% growth

Budget 2014-15 framework eyes restricting deficit at 4.8% of GDP.

-

Week-on-week: Forex reserves increase 10.7%

The central bank’s foreign exchange reserves increased by $780 million to $8,020 million.

-

IPS pre-budget seminar: Experts urge strong institutional framework

Inefficient tax mechanism, subsidy system banes of the economy.

-

Ports and shipping: Minister updates NA on developments

Says PM has approved projects to make Gwadar functional.

-

Housing sector: ABAD presents its budget proposals

Asks for reduction in duty, registration fees, indirect taxes.

-

Market watch: MSCI announcements boost index, volumes

Benchmark KSE-100 index gains 314.83 points.

-

Flare gas: Government plans to add 100 mmcfd to system

Flare gas could be consumed by fertiliser, power and CNG sectors.

-

Pakistan hopes Walt Disney will ease export curbs

Country working to address labour issues, says textile minister.

-

Pakistan-based companies to increase in MSCI index

Pakistan Tobacco, K-Electric, Lucky Cement and PSO chosen.

-

10MFY14: FDI falls 12.9%, data reveals

Amounts to $750.9 million, April’s figures substantially low.

-

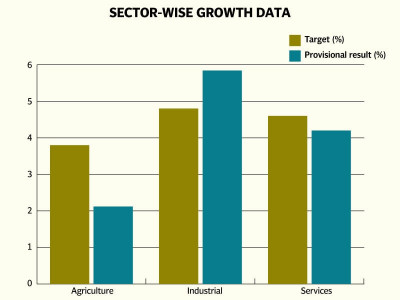

Shortcomings: Weak spending keeps GDP growth below target

NAC puts growth at 4.14% with major support from industrial sector.

-

As time changes, Intel eyes markets of 2 in 1s, re-imagined desktops and Internet of Things

Intel says there were never more opportunities to grow as computing industry undergoes rapid transformation.

-

Pak-US: Dastgir advocates greater trade access

Prime Minister Nawaz Sharif’s government is pursuing a policy of economic diplomacy, says minister.

-

Black market: Smuggling on the rise

Motorcycle assemblers preferring ‘cheaper’ parts.

-

Moving forward: Modern machines replace handmade embroidery

Rising purchasing power pushes for higher demand.

-

Trading information: Ministry unaware of any import of prohibited products

Desires to set up Pakistan Halal Authority through an act of parliament.

-

Market watch: Index closes above 28,500

Benchmark KSE-100 index gains 116.70 points.

-

ABAD talks: Foreign investment due in real estate sector

About 100 housing projects in Karachi within 4 months.

-

Borrowing cost: Reduced rate for exporters of textile proposed

Minister says incentives will focus on value-addition chain.

-

Threat of sanctions: Iran understands Pakistan’s stance on IP pipeline

Both sides are cooperating to take project forward.

-

Pressure: Donors press for liberalised market for gas producers

Ask govt to remove cap on gas prices and allow direct sales to consumers.

-

Pakistan’s economy: Words of appreciation by US official

Praises govt’s focus on energy, investment and economic reforms.

-

Plea: Textile sector appeals to reduce sales tax

Increase from 2% to 5% has the potential of crushing country’s exports.

-

FPCCI budget proposals: Tyre company expresses dismay

Company says suggestions were mostly in favour of small-scale traders.

-

Saudi meet-up: Pakistan will issue Islamic bonds, says Dar

The Saudi ambassador too showed confidence in Pakistan.

-

Market watch: Index closes in the black

Benchmark KSE-100 index gains 67.61 points.

-

Power import: Pakistan, Afghanistan out of sync over transit fee

Islamabad says Kabul should either waive or agree on a nominal fee.

-

Video-calling’s growth a threat to LDI operators

OTT a concern to national security as well, say officials.

-

Reduced tax on listed, dividend-paying firms proposed

To offset this, income tax on small companies may be increased.

-

Govt borrowing in the negative, reveals data

Decline due to reduced reliance on local sources.

-

Review: New chapter opens for the IP agreement

Both countries will work towards re-evaluating the pipeline.

-

Unrealistic tax target: FBR holds finance ministry responsible for fiasco

Asks govt to do away with Rs230b worth of tax exemptions next year.

-

Auditor’s remark: Snags may hold up PSM privatisation plans

Auditor says not in a position to give any opinion on account of the corporation.

-

Endorsing technology: E-governance to improve efficiency

The objective is to enhance cooperation & develop inter-working mechanisms among all federal ministries and divisions.

-

Taxation: ICAP sets out proposals for upcoming budget

Tax base should be broadened, review board should be formed.