Weekly review: KSE-100 gains 389 points on MSCI upgrade

Volumes remained lacklustre as investors awaited monetary policy announcement.

Volumes remained lacklustre as investors awaited monetary policy announcement.

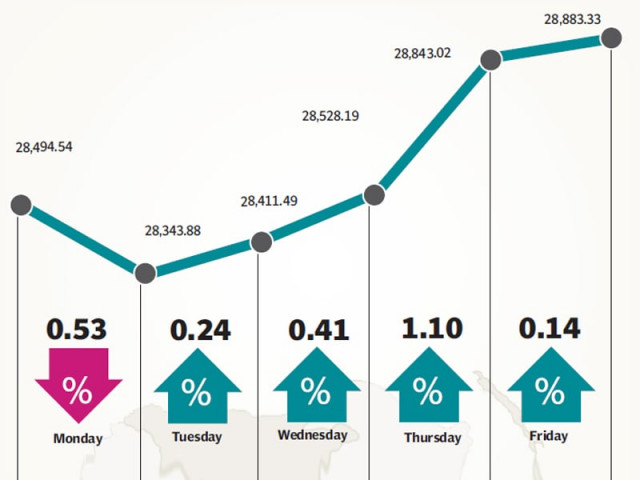

The stock market bounced back with the KSE-100 index climbing 389 points (1.4%) following the MSCI increasing the country’s weight in its Frontier Markets index from 3.88% to 7.02%, during the week ended May 16.

Positive macroeconomic figures along with sector-specific activity aided the index’s growth as volumes remained subdued due to investors staying on the sidelines ahead of the monetary policy announcement on May 17.

The week started off on a negative note as the market adjusted to the notion of no cut in the discount rate, following the International Monetary Fund’s comments requesting the government to keep inflation in check and refraining from monetary easing.

Analysts remain divided about the upcoming monetary policy with the majority leaning towards the State Bank maintaining status quo at 10%, while some analysts believe that the central bank will reduce the discount rate by 50 basis points. The announcement is likely to determine the direction of the market in the coming week.

Despite the slow start, the market slowly crept upwards in the following sessions and 314 points (1.1 %) on Thursday following the completion of the MSCI review in which the country’s weight in the MSCI Frontier Markets index rose to 7.02%.

The revision also saw the inclusion of Pakistan State Oil, Lucky Cement, Pakistan Tobacco and K-Electric in the MSCI FM index, resulting in improved activity in these companies. Hub Power Company was dropped from the index, while the weight of OGDC and MCB Bank was increased.

The revision had an immediate impact as foreigners rushed to invest in the bourse, buy a net of $20 million worth of equity during the week. Foreigners have so far purchased a net of $33 million worth of equity during the month of May.

There was positive news from the macroeconomic front as the Finance Minister Ishaq Dar announced that the country is likely to have foreign exchange reserves of $15 billion by the end of June 2014. This came at the conclusion of talks with the IMF, in which the lender agreed to release US $ 550 million by June 1 to the country. Remittance figures for the ten-month period of the current fiscal year saw a jump of 11.5% to $12.89 billion.

The textile sector took centre stage this week as the government announced its plans for a new Textile Policy which aims to enhance exports and hit $26 billion by 2019. Nishat Mills and Nishat Chunian were the major beneficiaries and saw renewed interest and closed the week on their respective upper locks.

Average daily volumes dropped 5.5% and stood at a lowly 133 million shares traded per day. Similarly, average daily values also fell to Rs5.99 billion traded per day, down 3.1% over the previous week. The market capitalisation of the Karachi Stock Exchange stood at Rs6.91 trillion at the end of the week.

Winners of the week

Packages Limited

Packages Limited manufactures and sells paper, tissue products, paperboard and packaging materials. The group has joint venture agreements with Tetra Pak International, to manufacture paper for liquid food packaging, the Mitsubishi Corporation, to manufacture polypropylene films, and Print care (Ceylon) Limited, to produce flexible packaging materials in Sri Lanka.

Hum Network Limited

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Murree Brewery Company Limited

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan Made Foreign Liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the Group’s bottles and jars.

Losers of the week

NIB Bank Limited

NIB Bank Limited is a commercial bank operating in Pakistan.

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Javedan Corporation

Javedan Corporation Limited manufactures Portland cement, blast furnace slag cement and sulphate resisting cement.

Published in The Express Tribune, May 18th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ