Unrealistic tax target: FBR holds finance ministry responsible for fiasco

Asks govt to do away with Rs230b worth of tax exemptions next year.

The government has already revised the target downward twice to Rs2.275 trillion, lower by Rs200 billion. PHOTO: FILE

While proposing withdrawal of over Rs230 billion in tax exemptions in the upcoming budget, the Federal Board of Revenue (FBR) has distanced itself from this year’s tax target of Rs2.475 trillion and held the Ministry of Finance responsible for setting an unrealistic target.

The FBR’s move also puts a question mark over next year’s proposed revenue target. The government has already agreed with the International Monetary Fund (IMF) that it will collect Rs2.8 trillion in fiscal year 2014-15, which is again Rs100 billion higher than what the FBR is suggesting.

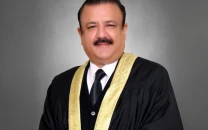

“The FBR will propose that tax exemptions equal to 0.9% of gross domestic product (Rs234 billion) could be withdrawn next year,” said FBR Chairman Tariq Bajwa.

He was responding to a question put up by Senator Sughra Imam of the Pakistan Peoples Party (PPP) in a meeting of the Senate Standing Committee on Finance here on Tuesday.

The FBR has estimated the cost of tax exemptions granted over the years to the affluent at Rs480 billion per annum.

“All of these exemptions cannot be withdrawn, as some are socially sensitive while others are protected under the constitution,” Bajwa said, adding budget would be announced in the first week of June.

According to him, in the first seven months of the current fiscal year, Rs320 billion worth of exemptions were given. Income tax exemption for electricity producers is protected through agreements and will not be easy to withdraw.

While the FBR wants early withdrawal of exemptions, as also desired by the IMF, a final decision will be taken by Prime Minister Nawaz Sharif.

Controversy

Cornered by growing criticism over failure to achieve this year’s Rs2.475 trillion tax target, Bajwa, for the first time, said it was never the FBR’s target, as during budget-making, it had proposed the figure of Rs2.344 trillion.

The government has already revised the target downward twice to Rs2.275 trillion, lower by Rs200 billion. “I expect to receive Rs2.270 to Rs2.275 trillion this year,” said Bajwa.

Any collection below Rs2.344 trillion was the result of a decline of 10% in goods import while the appreciating rupee also hurt collection at the import stage, he said. About 41% of total revenues are received at the import stage.

Next year’s target

Though the FBR chairman did not disclose next year’s tax target, the government has agreed with the IMF to set it at Rs2.8 trillion to keep budget deficit at 4.8% of GDP. According to sources, this will not be the FBR’s target, like the outgoing fiscal year.

The IMF had suggested Rs2.9 trillion while the FBR put the figure at Rs2.7 trillion. During negotiations, Finance Minister Ishaq Dar agreed on Rs2.8 trillion, sources said.

But Bajwa said his tax target for next year would be one that was backed by the required tax measures.

Tax drive

Denying any list of 3.2 million potential taxpayers, Bajwa said action could not be taken on the basis of data collected by the National Database and Registration Authority (NADRA).

“If a person has a bank account, it does not mean that his income is taxable,” he said – a statement that is contrary to the law passed by parliament to get access to bank accounts of potential taxpayers.

“It’s not a difficult task to identify people from NADRA’s data source,” said Saleem Mandviwalla, member standing committee and former finance minister.

Bajwa said the FBR had obtained details of property transactions in Lahore, Karachi and Islamabad in an attempt to approach these people to disclose their source of income.

The FBR had also got details of those who bought luxury vehicles like BMW and Mercedez, he added.

Published in The Express Tribune, May 14th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ