FBR

More News

-

FBR decides to revamp IMS for restaurants

Recommends punishments for not installing system meant to stop evasion of sales tax

-

FBR may face Rs100b shortfall in first quarter

Wide gap may force taxmen to take advances from banks, big firms

-

90 named in Panama leaks avail PTI govt amnesty scheme

FBR seeks help of OECD for getting details of other Pakistanis holding offshore assets

-

FBR is in shambles: CJP Gulzar

Justice Gulzar Ahmed asks tax authority to report regarding Rs90m corruption case

-

FBR makes quarterly adjustments to meet annual revenue target

Share of income tax in total tax collection reduced to slightly over Rs2trn while sales tax and fed excise duty go up

-

FBR to track sales at beauty parlours, bakeries

FBR to extend scope of Invoice Monitory System nationwide

-

PTI govt fails to step up drive against Benami assets

Investigations severely hampered due to lack of human and financial resources

-

Afghan transit trade ‘hurting Pakistan's economy’

FBR report blames the agreement for black marketing

-

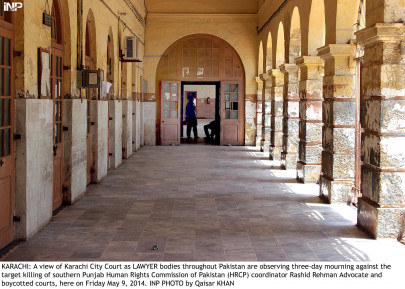

Lawyers get stay on paying sales tax

IHC orders appointment of ad hoc PARC chairman

-

EEF facility for overseas Pakistan in offing

PM Imran orders relaxing import conditions for countrymen abroad

-

FBR tightens noose on Benami asset holders

Notifies benches in Islamabad, Lahore and Karachi to hear such cases

-

IMF refuses to revise projections despite poor fiscal results

Washington-based lender keeps 2.4% low GDP growth rate forecast

-

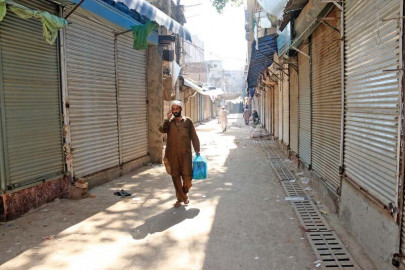

Traders announce Islamabad march on Oct 9

Negotiations over fixed tax scheme with FBR fail

-

FBR pulls plan for sales tax relief to car assemblers

Withdraws summary seeking cabinet's approval to lower sales tax liabilities for auto sector

-

Track system for cigarette firms feared to face more delay

Deadline for submitting EOIs for installing system likely to be extended

-

Senate body stresses on eliminating double taxation

Members call for focus on easing matters for investors, businessmen

-

'Loopholes in tax form to make returns difficult'

Experts say document includes certain parts pertaining to wealth reconciliation

-

Amendments to Income Tax Ordinance 2001 proposed

Move aimed at ensuring financial institutions submit annual reports before deadline

-

Catch these evaders!

The manufacturers were also understating their cost of sales by showing them as margins of distributors

-

FBR sets up RAC to boost exports

Makes additional collectors customs in-charge of the authority

-

PRC requests FBR to waive duties

The authority has asked FBR to issue clearance certificate with immediate effect

-

Talks between FBR and traders fail again

Traders refuse to become part of formal economy, which may jeopardise govt plan

-

FBR officials told to record interactions with traders

Move aims at eradicating corruption in tax collecting body

-

FBR teams visit markets in Lahore

22 shops visited; retailers asked to update their records within 15 days

-

FBR issues Rs992m tax notice to private tv channel

Accuses channel of evading taxes through misrepresentation, concealment, and misuse of exemptions

-

FBR kicks off nationwide anti-smuggling drive

Special joint teams will check import documents of foreign items at all markets

-

FBR still functions on 20th century model

Cannot perform efficiently without large-scale restructuring of posts

-

Revenue shortfall widens to Rs70b in Jul-Aug

FBR collects Rs574b in taxes against target of Rs643.7b

-

FBR to launch crackdown on smugglers from Sept 1

Aims to stem inflow of goods through illicit channels that has badly hit local industries

-

FBR to review progress on FATF action plan

Will discuss Directorate of Customs Intelligence and Investigation’s performance

-

FBR opposes sales tax exemption for Gwadar Free Zone

ST on imported Gwadar warehouse goods to stay

-

FBR scales down target for business registration

Once again serves income tax notices on wealthy people

-

FBR to inspect markets for smuggled goods

Teams of revenue board to start visiting major shopping areas from September

-

FBR takes measures to boost collection from WHT

Industrial, commercial energy consumers to be issued notices to file returns

-

FBR recovers just $6m from OECD treasure trove

Briefs NA panel on recovery and actions taken in offshore account cases

-

FBR waives CNIC condition for traders by two months

Govt was planning to enforce the order on the purchase of over Rs50,000

-

FBR seeks report on benami scheme from departments

Documents reveal billions of rupees worth properties surfaced during last amnesty scheme

-

Importing taxpayers

In its attempts to cast a wider tax net, PTI govt appears to not notice the influential in its own ranks

-

FBR sets ups anti-benami directorate

Directorate will be authorised to seize luxury vehicles, offshore investments, bank accounts, stocks and shares

-

Govt forms panel on benami assets

The Benami Information Processing Committee will function on the pattern of a joint investigating team

-

FBR amends rules for ‘resident Pakistani’

Top tax authority issues ‘corrigendum to circular’ to avoid possible litigations

-

FBR moves to bring small traders into tax net

Unveils drafts of simplified income tax returns to address concerns

-

Tax collection stands at Rs278 billion in July

FBR misses target by Rs14b, faces daunting task of collecting Rs5.5tr in FY20

-

PTI govt fails to weed out corrupt FBR officers

Taxmen have been accused of giving bogus sales tax refunds, providing undue tax benefits

-

FBR to decide on declaration of assets

Those who deposited tax challan by July 3 midnight are seeking permission to declare their assets

-

FBR introduces strict law against smuggling

Smuggled goods, vehicles used in their transportation will be confiscated

-

Taxes imposed, increased on kitchen items

Cost of living to rise due to new levies; FBR issues notification

-

Govt sets up special cell to implement FATF action plan

Named the FATF Cell, the unit will function under the administration of the DG Intelligence and Investigation

-

Traders incensed by new fodder, produce taxes

Withholding tax on licences increased 900% in all categories

-

FBR withdraws 1% WHT on yarn traders

Manufacturers will now have to pay 0.1% turnover tax