Weekly review: KSE falls another 310 points amid uncertainty

Trading volumes drop 34% as investors wait for clarity.

Trading volumes drop 34% as investors wait for clarity.

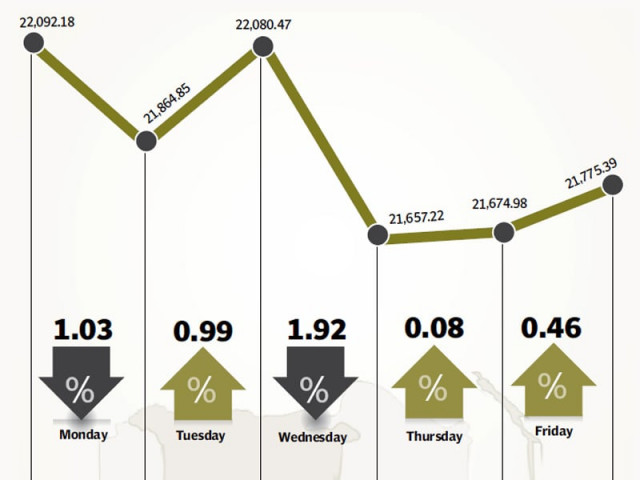

There was no respite from persistent selling on the stock market as the bourse continued its descent amid uncertain conditions with the benchmark KSE-100 index falling 310 points (1.4%) during the week ended October 11.

With an overall decline in corporate earnings, rising bond yields, re-emergence of circular debt and government shutdown in the United States, investors were left a bit shaken and chose to remain glued to the sidelines ahead of Eidul Azha holidays next week.

The corporate earnings season for the June quarter came to a close following an overall decline in earnings, especially among market heavyweights like the oil and gas sector. Investors expect the trend to continue into the September quarter and remain apprehensive about coming corporate announcements.

There was also talk of a further increase in the discount rate in the November monetary policy announcement by the State Bank of Pakistan. Concerns were heightened by a rise in Pakistan Investment Bond’s 10-year yields, which currently stand at around 13%.

Concerns were also raised about the state of energy and power sector after the government decided to rescind the recently announced hike in power tariff. It is believed that the sector’s circular debt, which the government eliminated by August this year, is emerging again as power producers are unable to generate enough income due to line losses and power theft.

However, the National Electric Power Regulatory Authority issued a notification on Friday evening, announcing almost the same increase in power tariff, which the government withdrew earlier following orders of the Supreme Court.

The global scenario also came into play as the US government entered its second week of shutdown which could lead to a stalemate over the increase in the country’s debt ceiling, resulting in default on its debt. Such a scenario could cause a global economic slowdown and take its toll on all Asian markets.

There was good news, however, for the banking sector as it emerged that the State Bank of Pakistan was considering either lowering the minimum deposit rate or capping it at a certain level in the event of a further increase in the discount rate. The banking sector, which took a battering in the previous week, outperformed the market by 1.1% during the current week.

The cement sector also performed well following price hike in the previous week and strong sales for September. The sector outperformed the broader market by 0.7% during the week.

On the macro front, remittances from overseas Pakistanis grew 9.1% in the first quarter of fiscal year 2013-14 and stood at $3.93 billion. Trade deficit for the quarter shrank 5% compared to the same period last year.

Trading volumes fell sharply by 34% during the week and stood at an abysmal 98 million shares traded per day on average. Average daily values were down 45% and stood at Rs3.30 billion. Market capitalisation totalled Rs5.19 trillion at the end of the week.

Winners of the week

Hum Network Limited

Hum Network operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Pak Services

Pakistan Services is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide rent-a-car, travel arrangements and tour packages.

Rafhan Maize Products Company

Rafhan Maize Products Company produces corn oil, industrial starches, liquid glucose, dextrin, gluten meals, and other corn related products. The company also produces a wide range of co-products such as gluten feeds, meals, and hydrol.

Losers of the week

Askari Commercial Bank Limited

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu and Kashmir and Bahrain.

Hub Power Company Limited

Hub Power Company Limited owns, operates and maintains an oil fired power station in Pakistan. The company delivers electricity for distribution to industrial, agricultural, and domestic customers. Hub’s clients include the Water and Power Development Authority.

Colgate-Palmolive Pakistan

Colgate-Palmolive Pakistan manufactures and sells detergents, personal hygiene, and a variety of other products.

Published in The Express Tribune, October 13th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ