Corporate results: Attock Group grows across the board

Cement wing profits double to Rs507 million.

Corporate results: Attock Group grows across the board

Attock Group, the only vertically integrated group in the country’s oil and gas sector, announced stellar earnings on Wednesday with all three subsidiaries – petroleum, refinery and cement – showing healthy growth in profits.

Delighted by the overall performance, the board of directors in their meeting held in Dubai, United Arab Emirates declared dividends from all three subsidiaries. The group is involved in the complete process of exploration, production, refining and marketing of the product, making it vertically integrated.

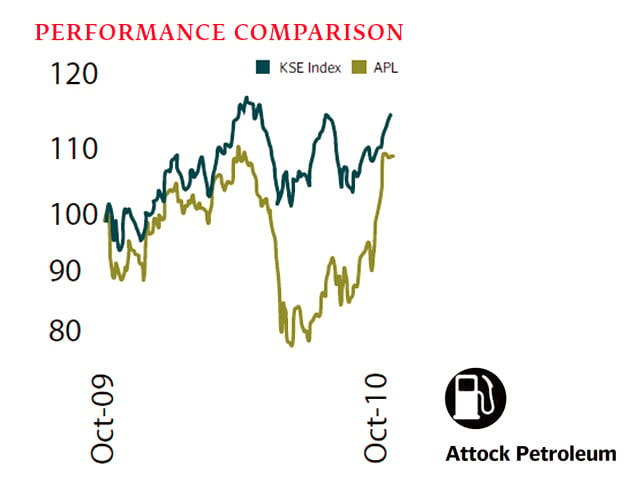

Attock Petroleum wing’s net profit rose 28% to Rs2.32 billion on the back of increased sales. The result was accompanied by an interim cash payout of Rs17.5 per share.

Increase in earnings primarily stems from improved volumetric sales by 35% on a yearly basis, said Topline Securities analyst Nauman Khan.

Volumes of high speed diesel, petrol and furnace oil have grown by 2.1, 1.6 and 1.1 times, respectively. The government’s decision to increase oil marketing companies’ margins has resulted in diesel and petrol margins to rise by 12% and 4%, respectively.

Further support to the profit came from higher other income that rose by 20% to Rs1.8 billion mainly due to improvement in commission and handling income coupled with mark up received on late payments.

Refinery wing

Attock Refinery profits were boosted 56% to Rs2.32 billion in the first half of fiscal 2012 as the company tweaked its product mix to give profitable products petrol and diesel a higher weight-age.

Improved result primarily stems from better core-refinery operations and higher other income, said Khan. The company declared an interim cash dividend of Rs1.5 with the result.

The company’s gross margins improved to 3% as against 2% last year, while gross profits have jumped by 113% to Rs2.0bn against meagre Rs932 million last year.

In addition, the company’s other operating income rose by 140% to Rs1.1 billion, while higher dividend payout from its associate companies Attock Refinery and National Refinery.

Cement unit

Attock Cement Pakistan profit more than doubled 116% to Rs507.10 million, higher than market expectations. The company also announced an interim cash dividend of Rs2.50 per share.

Net sales jumped 20% to Rs4.55 billion against sales of Rs3.78 billion in the same period last year on the back of higher prices, said Summit Capital analyst Muhammad Sarfraz Abbasi.

Price per bag reached Rs425 during July to December against per bag price of Rs339 in the corresponding period last year. Being the only de-leveraged company, Attock Cement is enjoying an edge over its competitors due to lower finance cost, said Abbasi.

Going forward, the company’s profits are expected to increase on higher sales and prices, added Abassi.

Published in The Express Tribune, February 2nd, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ