Siemens offers $2.5b credit facility for TAPI pipeline

Will supply compressors against a loan, more funds will be raised in road shows

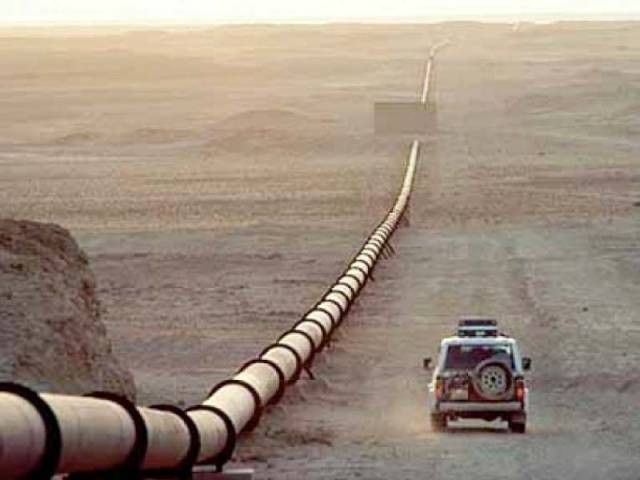

Will supply compressors against a loan, more funds will be raised in road shows. PHOTO: FILE

According to officials having knowledge of the development, TAPI Company, established by the four countries with the task of laying and operating the pipeline, will need to install nine compressors for transmitting gas from energy-rich Turkmenistan to Afghanistan, Pakistan and India. Under the $2.5-billion supplier credit facility, Siemens will provide compressors against a loan. Remaining funds for the pipeline project will be generated through road shows in different countries such as the United Arab Emirates (UAE) and Singapore, officials say.

Four countries ink deal for $10 billion TAPI gas pipeline project

Turkmenistan has agreed, in principle, to buy compressors from Siemens. Negotiations with the company are at an advanced stage and modalities of a deal are being finalised.

Turkmenistan will bear 85% of the total pipeline cost of $10 billion. The remaining will be shared by Afghanistan, Pakistan and India with 5% contribution each.

Of the 85% cost, Turkmenistan will contribute 51% on its own and arrange the remaining 34% from varying financiers. Other countries participating in the project could also enhance their investment share, if they so desire.

Apart from the $10 billion required for building the pipeline that requires pipeline material and compressors, $15 billion will be needed for developing the gas field in Turkmenistan.

The field development project has been awarded to Japanese companies that are working on extracting gas against a service fee and will not become shareholders in the field.

Earlier, the Asian Development Bank (ADB) had played the role of transaction adviser for the project. Because of this, the bank expressed its inability to finance the project as it would lead to a possible conflict of interest.

ADB offers $1b loan for TAPI gas pipeline

However, now it has given up its role of transaction adviser and has offered $1 billion in financing.

The ADB, which is dominated by Japanese members, has offered funds after a consortium of Japanese companies won the contract for developing the gas field in Turkmenistan.

The Islamic Development Bank (IDB), dominated by Saudi Arabia, has also offered a loan of $500 million for the pipeline. Riyadh is a major shareholder in the bank with 23.5% stake.

TAPI Company is expected to achieve financial close of the project by the end of this year.

Published in The Express Tribune, December 15th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ