Taxation

More News

-

New taxes on mobile phones set to drive prices higher in Pakistan

25% sales tax will be imposed on completely built-up mobile phones valued over $500

-

Country's critical sectors need to be privatised: Aurangzeb

"No class or sector that can remain outside the scope of direct taxation," FM Aurangzeb on issue of tax evasion

-

Govt’s Rs4.23tr stuck in court tax cases

Billions held up due to appeal stage delays

-

Income taxation of SMEs

Simplified income tax regime has, therefore, always been strongly advocated by SMEs

-

Govt to focus more on HR

Will bring undocumented economy and people to tax net, says PM

-

Govt eyes Rs740b in additional taxes

Rs300b to be collected through petroleum levy

-

Govt urged to improve taxation system

ICCI chief suggests automating system to reduce people-to-people contact

-

Taxation or rent seeking?

The purpose of taxation is primarily to raise revenue for the government

-

Medical experts urge higher taxes on tobacco products

"Taxation is known to be the most cost-effective control measure available to governments throughout the world"

-

Traders seek sizable reduction in taxes

Say it will help revive economic activities in Pakistan

-

FBR chairman assures all-out support to AJK CBR chief

Chairman CBR Farhat Ali Mir meets Ghani at FBR secretariat in Islamabad to discuss taxation related matters

-

Punjab’s tax collection rises 7%

Performance report shows taxpayer base widens 40% in two years of PTI govt

-

Cement-makers ask PTI govt to cut taxes

Manufacturers say otherwise they may have to raise cement prices by around 10%

-

Too many cooks spoiling the broth, FBR tells PM Imran

Federal Board of Revenue raises the issue of multiple stakeholders with PM Imran Khan

-

Ministry to consult FBR on refund claims

Official says Pakistan responded to crisis better than other Asian countries

-

FBR’s tax refunds swell to Rs578 billion

Authority has yet to clear income tax refunds of up to Rs50m as per Hafeez Shaikh’s directive

-

FBR directed to clear Rs50m tax refunds

Finance adviser asks for adopting clear strategy for release of remaining refunds

-

Auto sector rejects FBR’s data demand

'Forcing companies to submit data again and again will add to bureaucratic hurdles'

-

E&T Dept opens facilitation centre at LCCI

Businessmen will get rebate on property tax, concession on vehicle token tax

-

Tax refunds amount to Rs532b: FBR

Tells NA committee about Rs220b worth of administrative measures taken in budget

-

FBR keeps tax refunds secret

Issue of paying Rs16b in refunds in return for kickbacks lands in NA

-

4th FBR chairman shown the door in 22 months

Javed Ghani given acting charge after Nausheen Amjad removed

-

Pakistan uses tech to boost tax ratio

Aims to deploy 8,500 electronic devices like POS at retail outlets by end of Dec 2020

-

PTI govt gives Rs1.15tr in tax break

Highest amount of tax concessions given in FY20 to affluent people

-

Pakistan may end special tax system

Considers bringing foreign companies on par with local firms

-

FBR seeks uniform tax on profit

Faces resistance to withdrawing concessions on foreign currency accounts

-

Businesses urge FBR to take back discretionary powers

Insist such decision will provide relief to taxpayers, simplify tax laws

-

Industrialists seek extension in deadline for DDT claims

Businessmen say lockdown, less working hours have impacted efficiency of trade, industry

-

Bailout funds and global tax avoidance chains

Tolerance of tax loopholes is decreasing in corona-hit EU states

-

FBR’s collection slumps 17% in April

Lockdown impacts tax collection; govt also reshuffles top hierarchy of revenue body

-

Adviser to PM Imran on Commerce for improving direct tax receipts

Abdul Razzak Dawood says it will help reduce indirect taxes like sales tax

-

FBR closes 310,000 tax audit cases

Cases selected for 2014-17 due to taxpayers’ failure to file returns on time

-

Tax refund claims surge to Rs348b

External audit required to determine exact quantum due to claims and counter claims

-

SC gives ruling on delay in tax refunds

Supreme Court says compensation can be claimed after issuance of refund order

-

FBR misses deadline for release of Rs100b tax refunds

PM Imran Khan had promised immediate relief to improve liquidity of businesses

-

Can we do taxes better?

How can we do taxes better if no one listens?

-

Centre, provinces agree on body for uniform taxation in Pakistan

Move will pave way for two World Bank budgetary support loans worth $750m

-

PTI govt orders release of Rs15b in blocked tax refunds

Parliamentarians seek reversal of 17% sales tax levied on export-oriented sector

-

'PTI to impose extra Rs900b taxes next year'

Dr Hafiz Pasha says Pakistan needs radical tax reforms through tough decisions in upcoming budget

-

FBR expects substantial cut in tax target by IMF

Finance ministry denies global lender has agreed to downward revision

-

FBR unearths tax theft within Sindh’s mines

Mines’ lease-holders have failed to pay Rs51b in tax to the Centre over the last four years

-

FBR waives regulatory duty on wheat, sugar import

Move aimed at pushing down prices of commodities

-

PTI govt to increase TT reimbursement by 100%

Steps aimed at promoting legal channels of sending remittances

-

PTI govt gears up to tackle under-invoicing, increase tax-to-GDP ratio

FBR issues notification to set up Directorate General Risk Management

-

Excise dept launches tax self-assessment portal

The soon to launch portal is expected to prevent corruption and curb tax evasion in property taxes

-

Senate committee rejects changes to tax laws

Finance panel finds most of legal amendments in violation of constitution

-

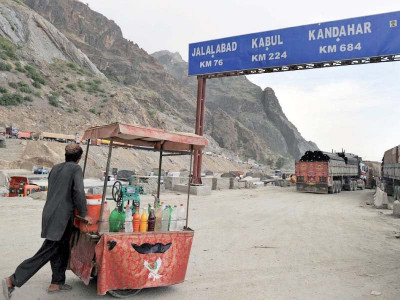

Report clears 159 vehicles of tax evasion at Torkham

Probe came after DG intelligence pointed to goods smuggling into country

-

'Over 50 taxes can be abolished without harming exchequer'

Punjab minister insists move will not harm public exchequer

-

Unnecessary duty, tax exemptions to end in next budget

Govt has also decided to add few sectors to tax net, which currently enjoy zero tax rates

-

Beneficial property taxation

As most people in Pakistan avoid paying taxes