tax

More News

-

Punjab Excise Dept to resume re-registering motor vehicles

In 2002, the excise department had revoked the authority of re-registering vehicles

-

Shrinking tax base

Government’s failures to meet the quarterly targets have added to the financial burden on the masses

-

Punjab govt may waive property tax for 24 UCs of RMC

Residents of these urbanised areas will pay due taxes prior to merger in Nov 2019

-

Sindh to levy tax ground, surface water for commercial use

It is proposed that an initial pricing of Rs1 per litre tax be placed

-

Pakistan's tax base shrinks, only 40% NTN holders file returns

Despite winning massive concessions, lower number of traders files tax returns

-

ePay Punjab pulls in Rs1 billion tax revenue in less than five months

ePay app provides general public with a stress-free and efficient method of paying all taxes

-

FBR waives regulatory duty on wheat, sugar import

Move aimed at pushing down prices of commodities

-

FBR Chairman Shabbar Zaidi on ‘indefinite leave’

Zaidi has been sick since January 9 due to which he had formally excused himself from working

-

Let's come together to tax tech giants, say G20 officials eyeing $100 billion boost

Global rules are being developed

-

Traders urge IMC to withdraw hike in taxes

ICCI president calls enhanced taxes unjustified, unacceptable to business community

-

Facebook faces off with IRS in big-ticket tax case

A multi-billion-dollar dispute

-

FBR begins crackdown on defaulting doctors

Hospital that fail to share details will be penalised under Pakistan Penal Code and Income Tax Ordinance

-

PTI govt to increase TT reimbursement by 100%

Steps aimed at promoting legal channels of sending remittances

-

PTI govt gears up to tackle under-invoicing, increase tax-to-GDP ratio

FBR issues notification to set up Directorate General Risk Management

-

People decry receiving property tax bills with 10-year arrears

It is a conspiracy against Punjab govt, says Parliamentary Secretary for Revenue Adnan Chaudhry

-

Centre transfers Rs1.5tr to provinces under NFC

This is not in line with annual projections due to heavy shortfall in tax collection

-

Senate committee rejects changes to tax laws

Finance panel finds most of legal amendments in violation of constitution

-

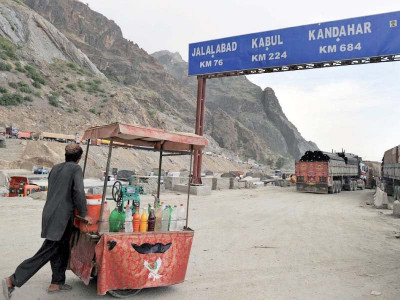

Report clears 159 vehicles of tax evasion at Torkham

Probe came after DG intelligence pointed to goods smuggling into country

-

'Over 50 taxes can be abolished without harming exchequer'

Punjab minister insists move will not harm public exchequer

-

Wheat support price expected to increase

PM forms five-member focus group to address reasons behind increase in food prices in Punjab

-

Pakistan to continue talks with IMF review team today

IMF delegation will be informed about the progress made on set targets

-

Punjab readies proposal on business activities by foreigners

Federal govt has sought recommendations from all provinces to regulate transactions made by non-citizens

-

Unnecessary duty, tax exemptions to end in next budget

Govt has also decided to add few sectors to tax net, which currently enjoy zero tax rates

-

Govt considers stopping tax collection for FBR

Provincial govt says revenue board is unilaterally deducting funds from its accounts

-

‘Elites have captured the state and market’

Ishrat Hussein says selection should be based on contribution rather than aristocracy

-

Each Pakistani now owes Rs153,689

PTI govt's Fiscal Policy Statement shows 28% rise in per capita debt at the end of FY19

-

Islamabad to establish data interfaces with Kabul, Dubai

Move aimed at combating under-invoicing, duty and tax evasion

-

FBR seeks access to bank lockers of tax defaulters

Tax authorities have proposed amendments to Incom Tax Rules 2002

-

PM Imran hopes for cut in interest rate

Business community meets prime minister to discuss hardships

-

Punjab Revenue Authority to establish stakeholders' body

It will take policy decisions after consultation with businessmen

-

PM Imran gives directives for swift sales tax refund

Tells commerce adviser to facilitate in expo centre construction

-

PM urges business community to pay taxes for country's prosperity

We are making all efforts to introduce tax culture and create business-friendly environment, says premier

-

Global corporate tax system must be overhauled: Apple CEO

Growth of internet giants has pushed international tax rules to the limit

-

Financial watchdog to get access to taxpayers’ data

Decision made to curb money laundering and terror financing in line with FATF action plan

-

PM Imran likely to unveil fixed tax scheme

Businessmen with an annual turnover of Rs100m will have to pay 0.5% instead of 1.5% tax

-

Punjab Revenue Authority tax collection increases 23% in H1FY20

Major business processes of PRA including registration, return filing and tax payments, all are fully automated

-

FBR amends tax laws, introduces penalties for defaulters

Traders, retailers under tier-1 may face fines for not registering with FBR's system

-

Customs intelligence identifies massive tax theft

Corrupt customs officials assisted fraudsters in evading duties worth billions of rupees

-

Ballooning debt

Debt servicing alone is projected to cost Rs3.2 trillion for the ongoing fiscal year

-

Excise department re-imposes cinema tax in Punjab

Has also decided to introduce new ratio, tax evaluating software across the province

-

FBR notices fall in WHT collection by some agents

Directs field formations to ascertain causes behind poor WHT receipts

-

FBR orders setting up of help desks to facilitate refund claims

19 RTOs, corporate RTOs and four large taxpayer units have been given instructions

-

FBR claims loss of Rs330b due to import compression

Misses first-half tax collection target due to low economic activity

-

Industry barred from tax refund on urea sales to unregistered dealers

Terms it arbitrary move that will adversely impact fertiliser sector, farmers

-

SBP simplifies non-resident companies’ tax regime

Move will encourage investment in long-term debt securities

-

FBR asked to follow up on deal with traders

Finance adviser directs tax authority to use modern communication tools

-

Tough decisions: 2019 sees Pakistan economy emerge out of deep waters

IMF’s bailout programme, delayed licence fee payments by telecom operators among others provide relief

-

Imran's govt may seek IMF nod for fixed tax regime

Committee formed to discuss issue which will give boost to construction sector

-

Urbanised union councils to get tax notices from January

People in these rural areas were until now not required to pay property, water tax

-

SBP to bear fee for online tax, duty payments

Move aimed at documenting economy, will cost central bank millions