Weekly review: KSE drops 0.8% as foreign investors continue to sell

Weakening oil prices, lack of triggers also kept investors from buying

Weakening oil prices, lack of triggers also kept investors from buying.

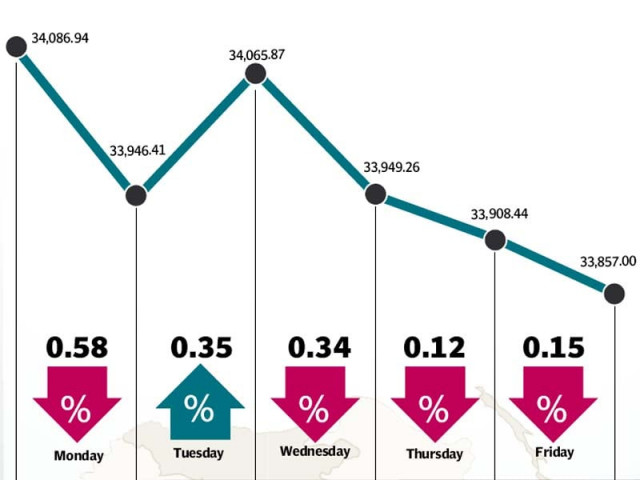

The stock market consolidated its position around 34,000 points and fell a meagre 0.84% in the week ended November 20, though foreign investors continued to offload their holdings and crude oil prices dropped 2.3% in the international market.

Towards the end of the week, many investors held off making major movements before announcement of the monetary policy statement by the State Bank of Pakistan on Saturday. The central bank kept the benchmark policy rate unchanged at 6% for the next two months and its impact on the bourse will emerge in trading next week.

The benchmark Karachi Stock Exchange 100-share index closed the week at 33,857 points, down 287.78 points over the course of five trading sessions. Only on Tuesday, the market made some gains, advancing 119.46 points and recouping more than half of the decline recorded a day earlier. On Monday, the index had dipped 198.37 points and taken cue from the weak regional and global markets following horrendous militant attacks in Paris on the evening of November 13.

A major feature that marked Wednesday’s trading session was the launch of All Shares Islamic Index by Finance Minister Ishaq Dar. This new addition to market indices did give some boost to the index during midday trading, but profit-taking and selling by foreign investors weighed on sentiments. The index eventually ended the day with a fall of 116.61 points.

In the remaining two sessions of the week, the index shed 40.82 and 51.44 points respectively in lacklustre and range-bound trading as investors were wary of making major moves in the absence of key triggers and ahead of the keenly-awaited monetary policy statement.

Almost all analysts anticipated that the central bank would hold the interest rate steady this time after a 50-basis-point reduction in the target rate in the previous policy announcement. Among major developments on the economic front, Pakistan received $350.8 million in foreign direct investment in July-October 2015, which was 24% less than the FDI received in the same period of preceding fiscal year.

On the positive side, the country’s current account deficit in the first four months of 2015-16 stood at $532 million, shrinking 71.9% compared to $1.9 billion in the same period of preceding fiscal year. The improvement came mainly because of the narrowing trade deficit in both goods and services. According to Elixir Securities, heavyweights Oil and Gas Development Company and MCB Bank were the top index movers during the week under review as they contributed 133 points to the KSE-100’s decline. They were followed by Engro (-39.67 points), Hubco (-23.28 points) and Pakistan Petroleum Limited (-21.52 points).

On the flip side, Mari Petroleum posted the highest weekly gain of 11.2% on account of monthly data that revealed the availability of hydrocarbons from two development and appraisal wells located in Mari field.

According to Topline Securities, foreigners were sellers during the week with net selling of $15.9 million worth of shares. They offloaded stocks in oil and gas and chemical sectors with selling of $9.4 million and $5.4 million respectively.

Average daily volumes declined 5% to 176 million shares while the average traded value fell 18% to Rs6.6 billion. The market capitalisation dropped 0.6% to stand at Rs7.2 trillion at the end of the week.

In the upcoming week, investor attention will be primarily focused on the unchanged monetary policy, crude oil price movements and regional stock markets amid expectations that the US central bank will announce a monetary tightening shortly.

Winners of the week

Associated Services Limited

Earlier called the Latif Jute Mills Limited, the company is one of the industrial machinery and services firms in Karachi.

Mari Gas

Mari Gas Company Limited specialises in the drilling, production and selling of natural gas.

Shifa International Hospitals Ltd

Shifa International Hospitals Limited runs medical centers and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetrics and gynaecology, dentistry, rehabilitation services and ophthalmology.

Losers of the week

Bannu Woollen Mills

Bannu Woollen Mills Limited manufactures and sells woollen yarn, cloth and blankets.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Oil and Gas Development Company

Oil and Gas Development Co Ltd explores and develops oil and natural gas properties in Pakistan.

Published in The Express Tribune, November 22nd, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ