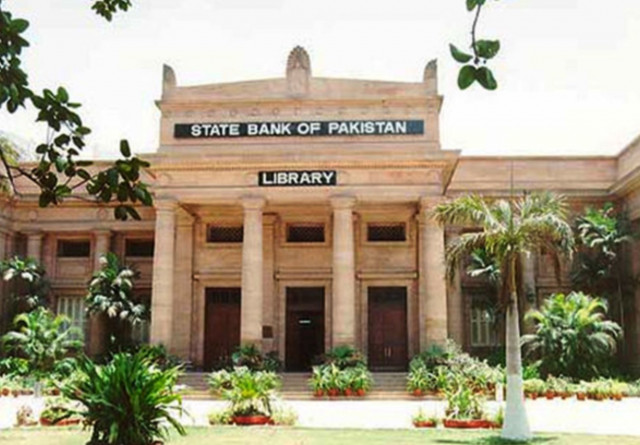

Export refinance: State Bank increases rate to 10 per cent

SBP increases rate of refinance under Export Finance Scheme.

The new rate will take effect from January 1, 2011. In a circular issued on Friday, the SBP said banks can charge a maximum margin of one per cent on financing facilities provided to exporters.

Pakistan Cotton Fashion Apparel Manufacturers and Exporters Association Chairman Khwaja M Usman said the central bank was expected to increase the refinance rate after a rise in the benchmark discount rate to 14 per cent at the end of November. “We believe that the increase in refinance rate will directly affect exports of the country,” he said.

Owing to a sharp increase in the cost of production of various exportable items, especially finished textile products, hundreds of small factories have closed down in recent months, he said. “Many of our friends who had four to five factories have stopped production from half of their units as they could not purchase costly raw material like cotton yarn and raw cotton.

“Now the situation is going from bad to worse as big names in finished textile products are shutting their industrial units,” he said.

Export refinance is a concessional financing facility designed by the central bank to help exporters compete in the international market.

Pakistan Apparel Forum Chairman Jawed Bilwani said the increase in the cost of export finance would mostly hit textile exports.

Replying to a question, he said the increase in imports of textile machinery did not mean that the industry was investing more, but it was mainly because of the fact that old machines needed to be replaced after every three or four years.

“No industrialist will invest in the country at this point in time when energy is not available,” he firmly said, adding “I don’t see a notable increase in exports in the remaining months of this fiscal year.”

Chairman SITE Association of Industry, one of the biggest industrial zones of the country, Wahab Lakhani said a one per cent increase in interest rate was very negative for exports.

Lack of financing or costly financing from banks was crippling the industry but the government seemed indifferent to the problem, he added.

Published in The Express Tribune, January 1st, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ