Weekly review: Volatile week ends with KSE-100 down 556 points

Concerns over international markets and regulatory tightening wiped off earlier gains.

Concerns over international markets and regulatory tightening wiped off earlier gains.

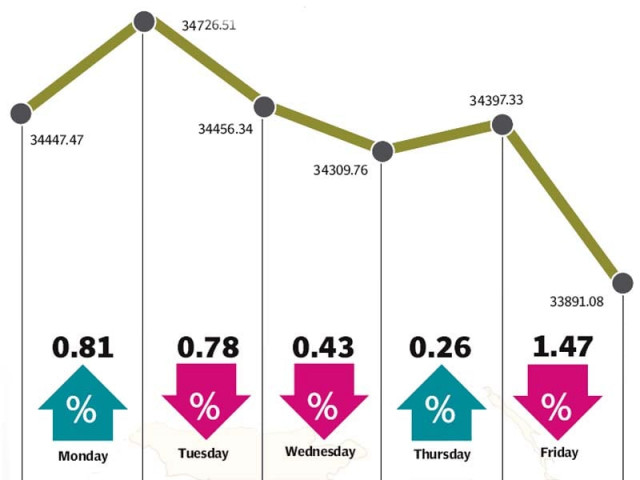

Severe volatility was witnessed at the stock market as concerns over international markets and regulatory tightening led to the benchmark KSE-100 index falling by 556 points (1.6%) during the week ended September 4.

The KSE-100 index had a rollercoaster ride, rising and falling sharply within trading sessions as pressure from international markets emanating from the Chinese stock market crisis took its toll on the bourse. Concerns about regulators taking action against capital market participants led to panic selling at the end of the week.

The decline occurred despite a strong recovery in global crude oil prices and the announcement of extremely low inflation figures for the month of August. Foreigners too, turned net buyers during the week, but could not stem the tide of local selling.

The week started off on a positive note as global crude oil prices rebounded sharply over the weekend following impressive economic growth numbers by the United States. However, the rally was short-lived as the index shed all of its gains the following day due to the announcement of the gas tariff hike and pressure on the cement sector.

The index remained volatile throughout all trading sessions but managed to remain flat till Thursday on the back of rising crude oil prices. However, the index dropped sharply by 506 points (1.5%) on Friday due to the regulator’s actions against stock market brokers and resulted in the KSE-100 index closing at 33,891, down by 556 points over the previous week.

Proceedings at the market were, in large part, dictated by the state of international markets which are still reeling from the impact of the Chinese stock market crisis. Selling pressure in the US stock market prompted selling pressure across world markets and Pakistan was no exception.

The government finally announced the long-delayed gas tariff hike during the week and the news was met by scepticism at the bourse. The announcement led fertiliser manufacturers hiking the price of urea by Rs159 per bag, which was a positive for Engro Fertilizers and Fatima Fertilizers who continue to receive gas at concessionary rates at their new plants.

On the other hand, the cement sector remained under pressure throughout the week due to concerns over the breakdown of the pricing arrangement between cement manufacturers. Following the decision of DG Khan Cement to expand its production, Lucky Cement also indicated that it is planning an expansion of its own, which could result in a pricing war in the sector.

Foreigners returned to the bourse in full force and bought a net of $12.9 million worth of equity as opposed to the $42 million net sell-off in the previous week.

Average daily volumes fell 3.7% and stood at 289.4 million shares traded per day, while average daily values also fell 11.2% to Rs12.4 billion per day. The Karachi Stock Exchange’s market capitalisation stood at Rs7.34 trillion ($71.4 billion) at the end of the week.

Winners of the week

Bannu Woollen Mills Limited

Bannu Woollen Mills Limited manufactures and sells woollen yarn, cloth and blankets.

Sui Northern Gas Pipelines Limited

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes and supplies natural gas, in addition to marketing liquefied petroleum gas.

Murree Brewery Company Limited

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Losers of the week

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Maple Leaf Cement Factory Limited

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

Shezan International Limited

Shezan International Limited manufactures and sells juices, beverages, pickles, preserves, and flavourings which are all derived from fresh fruits and vegetables.

Published in The Express Tribune, September 6th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ