LHC ruling: Sharifs win income tax case after 19 years

Appeal filed in 1996 against assessment of Rs650 million income tax during PPP government

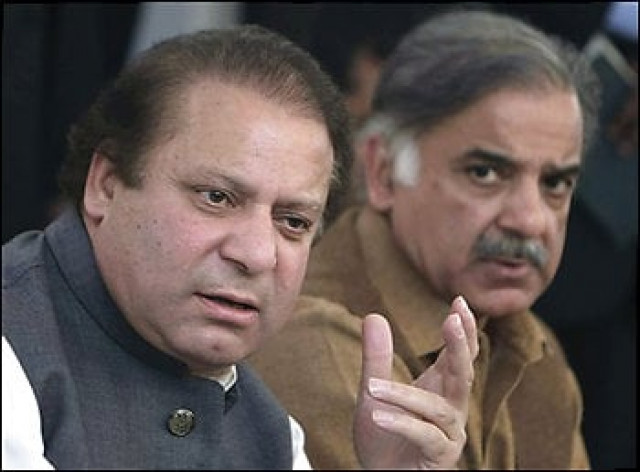

Appeal filed in 1996 against assessment of Rs650 million income tax during PPP government. PHOTO: FILE

After a 19-year long legal battle, the Sharif family finally got its appeal accepted against “wrongful assessment” of income tax.

The Lahore High Court (LHC) has suspended the 1989 verdict by Income Tax Appellant Tribunal against the Sharif family and the directors of Ittefaq Foundries. The court also accepted all appeals filed by the Sharif family in this regard.

A division bench of LHC has allowed an appeal filed by the Sharif family in 1996 against assessment by the Income Tax Department and subsequent decisions taken by a tax appellate tribunal upholding assessment for the year 1988-89.

Read: 150 mega scams: Sharif brothers, Zardari feature in NAB report

The assessment and subsequent appeals remained subject of political interference during the governments of PPP and PML-N.

The appellants are Nawaz Sharif, Shahbaz Sharif, Farooq Barkat, Iqbal Barkat, Hassan Barkat, Hussain Barkat, Zahid Shafi, Javed Shafi, Tariq Shafi, Pervez Shafi, Idrees Bashir, Aslam Bashir and Ittefaq Textile Mills.

The appellants said that the Income Tax Department had assessed the liability of the Ittefaq Group and its directors at Rs20 million, but the tax was raised to Rs400 million during late Benazir Bhutto’s first government in 1988. They said, on appeal before the department, during Nawaz Sharif’s first government in 1990, the amount was slashed to Rs20 million.

However, they said, during Benazir’s second tenure as premier in 1993, the Income Tax Department moved a second appeal and raised the tax amount to Rs650 million.

The appellants said the objection on assessment was raised after over 40 months instead of the 60-day stipulated period and was therefore illegal and asked the court to declare the assessment illegal.

Condoning the delay

The reference application by the Sharif family was admitted for regular hearing on June 9, 1996 and continued over the years till today.

On Monday, a bench comprising Justice Abid Aziz Sheikh and Justice Shahid Karim heard arguments on whether the income tax tribunal was justified in condoning the delay in filing the appeals.

Counsel for the Income Tax Department appealed that the appellants exercised political influence and had successfully manoeuvred their way out of the liability.

Read: Sharif family paid Rs5.2 billion debt, never asked banks to write-off loans

However, the bench observed that the department had failed to establish that action had been taken against any of the department’s functionaries for recalcitrance and negligence. It further observed that the counsel for the department had not been able to produce evidence showing that the appellants had exercised political influence before the tribunal.

The bench allowed the appeal and set aside the impugned decisions of the Income Tax Tribunal passed on July 16, 1995 and December 2, 1995.

Published in The Express Tribune, August 4th, 2015.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ