Market watch: Foreigners remain buyers, index still bleeds

Benchmark 100-share index falls 156.51 points

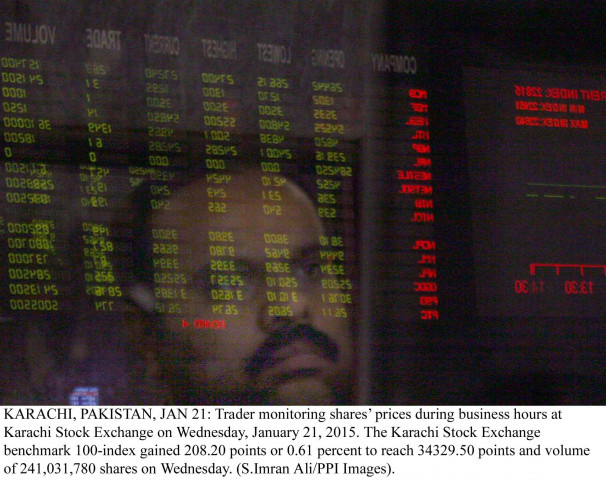

Ghani Automobile was the volume leader with 16.5 million shares, gaining Rs0.95 to close at Rs7.48. PHOTO: PPI

Rumours suggesting a possible hike in capital gains tax also spooked investors opting to remain on the sidelines ahead of the budget announcement. Despite likelihood of a possible rate cut in the upcoming monetary policy statement, trading activity remained lacklustre.

At close, the Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 0.48% or 156.51 points to end at 32,729.55.

Elixir Securities analyst Faisal Bilwani said most index names closed in the red with no major support at lows while yield plays effectively survived and attempted to weather the declines.

“Amid low turnover on budget-related anxiety, we expect a volatile market that tracks flows while any indication of local money managers aggressively buying will improve confidence,” said Bilwani.

Meanwhile, according to Topline Securities analysts, lower activity and fear of more taxes in the upcoming budget affected share prices.

“After announcing better than expected 9MFY15 results, Mughal Iron and Steel Industries (MUGHAL) closed at its upper limit as investors took fresh positions.

“Mutual funds were again major sellers with net selling of $5 million, while individuals and companies were major buyers of $2.9 million and $1.6 million, respectively,” they added.

Trade volumes rose to 136 million shares compared to 117 million on Monday.

Shares of 334 companies were traded on Tuesday. Of these, 124 companies closed higher, 191 saw a decline and 19 remained unchanged. The value of shares traded during the day was Rs6 billion.

Ghani Automobile was the volume leader with 16.5 million shares, gaining Rs0.95 to close at Rs7.48. It was followed by WorldCall Telecom with 13.1 million shares, gaining Rs0.24 to close at Rs1.60 and Byco Petroleum with 10.2 million shares, gaining Rs0.11 to close at Rs14.

Foreign institutional investors were net buyers of Rs97 million worth of shares during the session, according to data compiled by the National Clearing Company of Pakistan.

Published in The Express Tribune, May 20th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ