Weekly review KSE-100 bounces back as foreigners turn into buyers

Index fell 1,300 points before gaining 2,765 during eventful week.

Index fell 1,300 points before gaining 2,765 during eventful week.

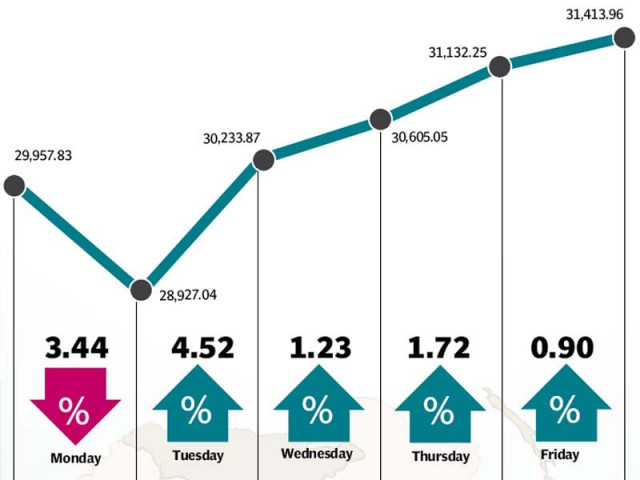

The stock market rebounded sharply after the streak of foreign selling came to an end, resulting in the benchmark KSE-100 index climbing 1,456 points (4.9%) during the week ended April 3.

The index managed to recover most of its losses from the previous week, when it fell 1,842 points due to panic selling. The sour mood at the bourse turned ripe due to a variety of factors with foreigners turning into net buyers being one of the most crucial reasons.

Low inflation numbers for the month of March and the approval of the International Monetary Fund’s sixth tranche boosted investor confidence, while the attractive valuations post last week’s freefall brought local investors to invest heavily at the bourse.

Although the index managed to end the week with an astounding gain of 1,456 points, it only told half the story of the market’s fascinating journey during the week. It started off with a disastrous opening day as the KSE-100 fell more than 1,000 points as panic-selling resumed and the index falling as low as 28,648 at one stage.

If Monday was disastrous, Tuesday was the exact opposite as the index rallied and gained 1,306 points in the best single-day performance in the bourse’s history. By the end of the week, the index had completed the turnaround close at 31,413 points on Friday.

After remaining net sellers for almost two complete months, foreigners returned to buying ways and were net buyers of $4.1 million worth of equity as compared to net selling of $15 million in the previous week. Investors took it a positive sign, although it remains to be seen if the inflows will continue in the coming weeks.

Another sentiment booster was the inflation number for the month of March which clocked in at a mere 2.49% and increased speculation about another discount rate cut in the next policy announcement. The news led to buying in highly-leveraged stocks, while proving to be somewhat of a dampener for the banking sector.

Despite the risk of another discount rate cut, the banking sector was the star performer of the week after having taken a severe beating in recent months due to the plummeting discount rate. Three of the country’s largest banks; MCB, UBL and NBP alone contributed 385 points to the index’s gains for the week.

On the other hand, the oil and gas sector performed poorly and knocked off 162 points from the KSE-100 after oil prices fell, following the nuclear deal between Iran and the United States, which could result in an additional 1 million barrels per day supply to the already oversupplied market.

Average trading volumes shot up by 45.3% to 253.82 million shares traded per day. Average daily values also improved 27% and were recorded at Rs11.97 billion daily. The Karachi Stock Exchange’s market capitalisation rose Rs221 billlion to Rs6.93 trillion at the end of the week.

Winners of the week

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Adamjee Insurance

Adamjee Insurance Company Limited underwrites insurance. The company offers fire, marine, automobile, engineering, and miscellaneous coverages. The engineering coverage includes contractor’s all risk, plant and machinery, electronic equipment and machinery insurance, and excise and customs, maintenance, and performance bonds. Miscellaneous includes health, accident, and liability.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Losers of the week

Indus Dyeing

Indus Dyeing and Manufacturing Company Limited manufactures and sells yarn.

Service Industries Limited

Service Industries Limited (SIL) is a public limited company listed on the stock exchanges of Pakistan. It is the largest manufacturer of footwear, tyres and tubes for two-wheelers, and has been the largest footwear exporter of the country for the last 10 years.

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

Published in The Express Tribune, April 5th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ