Weekly review: KSE surges 417 points following discount rate cut

Cement and fertiliser shares shine while oil and gas drag the index.

Cement and fertiliser shares shine while oil and gas drag the index.

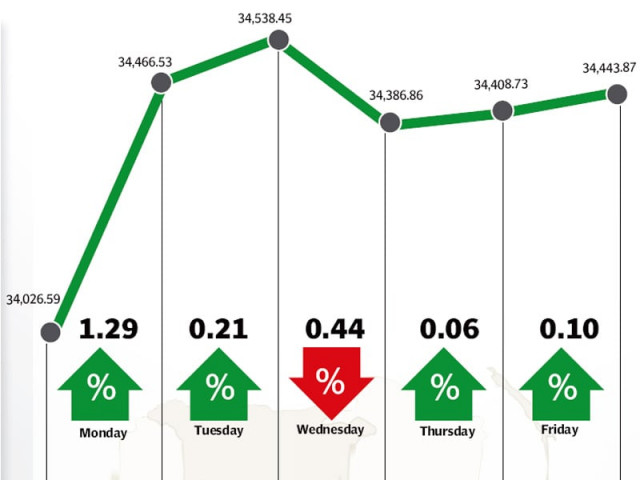

The stock market capped January in style as the benchmark KSE-100 index rose for the sixth consecutive week after the State Bank of Pakistan slashed the discount rate by 100 basis points.

The index rose 417 points and ended the week at a new record high of 34,443 points on Friday.

Although a discount rate cut was widely expected, the State Bank’s decision to cut the rate by 100 basis points instead of 50 resulted in jubilation at the bourse and investors rushed to buy stocks of highly leveraged companies.

The market’s reaction to the announcement was immediate as the index rose 440 points on Monday before climbing further to close at an all-time high of 34,538 points on Tuesday.

However, tensions in Karachi after the killing of a member of a leading political party resulted in the index receding on Wednesday and ending the week on a dull note on Friday.

The highly leveraged cement sector and Engro Corporation were the main beneficiaries of the discount rate cut and were the primary driving force behind the market’s gains for the week. However, the all-important oil and gas sector remained laggard with stagnant crude oil prices and below-expectation results from Pakistan Oilfields Limited and Pakistan Petroleum (PPL).

The cement sector was the star performer of the week owing to the rate cut. Maple Leaf Cement, DG Khan Cement and Lucky Cement led the way, climbing 9.5%, 7.6% and 3.7% respectively. The sector overall contributed 189 points to the index’s gains for the week.

Another strong performer was Engro Corporation, which continues to be highly leveraged, despite large repayments to lenders. The company’s share price rose 7.1% during the week and contributed 87 points to the index.

The company’s gains were supported by strong earnings from its subsidiary Engro Foods and the government’s announcement of expediting LNG imports.

The oil and gas sector, on the other hand, continued to be laggard and chipped away 173 points from the index’s gains. With crude oil prices stuck below the $50 mark and disappointing earnings announcements from Pakistan Oilfields and Pakistan Petroleum, the sector cast a shadow over the ongoing optimism at the bourse.

Foreigners continued to be net buyers, but barely so as they bought a net of $3.3 million worth of equity during the week, up slightly from $1.7 million in the previous week.

Average trading volumes fell slightly and stood at 298.5 million shares per day. Average daily values, however, rose 14.4% and stood at Rs19.4 billion. The Karachi Stock Exchange’s market capitalisation stood at Rs7.79 trillion ($77.2 billion) at the end of the week.

The upcoming week will be an interesting one as the inflation figures for January 2015 will be revealed. With fuel prices coming down, it is likely that the number will fall below the 4.3% reading for December 2014, which could fuel optimism for another discount rate cut in March.

Winners of the week

Arif Habib Corporation

Arif Habib Corporation Ltd. is a holding company. The company holds interests in the securities brokerage, investment and financial advisory, investment management, commercial banking, commodities, private equity, cement and fertiliser industries.

Kohinoor Textile

Kohinoor Textile Mills Limited produces textiles. The company weaves, dyes, and prints natural and synthetic fibres.

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Losers of the week

JDW Sugar

JDW Sugar Mills Limited produces and sells crystalline sugar. The company is located in District Rahim Yar Khan and formerly named United Sugar Mills Limited.

Shezan International

Shezan International Limited manufactures and sells juices, beverages, pickles, preserves, and flavorings which are all derived from fresh fruits and vegetables.

Attock Refinery

Attock Refinery Limited, a subsidiary of the Attock Oil Company, specialises in the refining of crude oil.

Published in The Express Tribune, February 1st, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ