Weekly review: Bourse comes down after hitting record high

Index rises 0.7% as rate cut expectations spark heavy investments

Index rises 0.7% as rate cut expectations spark heavy investments.

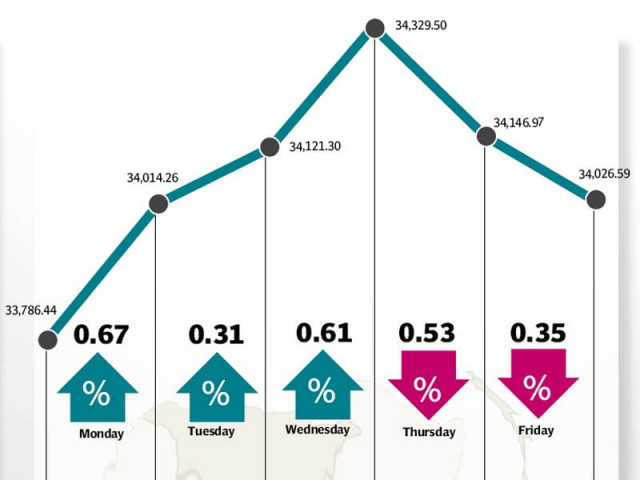

The Karachi Stock Exchange hit yet another record high during the week ended on January 23 and touched 34,330 points as anticipation of a discount-rate cut in the monetary policy triggered heavy investments.

As expected, the State Bank of Pakistan on Saturday announced a reduction of 1% in the discount rate, taking it to 8.5%.

The week started off with a strong earnings’ outlook and slight recovery in global oil prices, which led to a healthy beginning for the equities, though institutional selling on Thursday erased most of the gains.

The benchmark KSE 100-share index clocked up a modest rise of 0.7% week-on-week by Friday, closing at 34,027 points.

The market closed positive in three of the five trading sessions with institutional selling emerging in the latter half of the week.

In the middle of the week, petrol shortage in the country worsened and the government planned to release Rs40 billion to overcome the crisis, which pushed Pakistan State Oil (PSO) to close at its upper price limit. The state oil company closed the week in the black as the government ensured the payment on an immediate basis to reduce the energy chain’s debt.

Oil and Gas Development Company (OGDC) attracted investor interest with international oil prices stabilising. The company, relatively well-placed to bear the brunt of lower oil prices, added 111 points to the index.

Separately, fertiliser companies such as Fauji Fertilizer Company and Engro Fertilizer cumulatively added 179 points to the index on rumours that urea manufacturers would be exempted from the expected gas tariff hike.

Also, the fertiliser sector got a boost from strong cash and stock payout expectations in the upcoming results.

Another highlight of the week was the announcement by Hubco’s board that it would set up a 1,320-megawatt coal-fired power plant. The power sector continued its rally based on increasing attractiveness of dividends in a monetary easing environment, whereas leveraged sectors such as cement companies also encouraged interest.

Strong result anticipations in the cement sector kept the momentum intact.

Meanwhile, K-Electric (‐11.09%) remained under pressure due to the lapse of a dividend proposal.

The auto sector also remained in the limelight with local buying interest in Indus Motor Company and Pak Suzuki Motors on expectations of sales growth in forthcoming quarters.

Foreign investors remained net buyers of shares worth $6 million, compared to $17.6 million during the previous week.

Average trading volumes fell 8.8% and stood at 302.3 million shares per day. Average daily values rose and stood at Rs16.9 billion. The Karachi Stock Exchange’s market capitalisation stood at $76.7 billion at the end of the week.

Winners of the week

Indus Motor

Indus Motor Company Limited was created through a joint venture agreement between the House of Habib, the Toyota Motor Corporation and the Toyota Tsusho Corporation, in order to assemble, manufacture and market Toyota vehicles. The company is also the sole distributor of Toyota vehicles in Pakistan.

Mari Petroleum

Mari Petroleum specialises in the drilling, production and selling of natural gas.

Pace Pakistan Limited

Pace Pakistan Limited develops real estate in both the residential and commercial sectors. The Company develops and constructs shopping malls, supermarkets, and apartments.

Losers of the week

Pakistan Cables Limited

Pakistan Cables Limited manufactures and distributes copper rods, wires, cables and conductors, aluminium profiles and anodised fabrications.

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

K-Electric Limited

The K-Electric Limited is a private power producer, which transmits and distributes electricity.

Published in The Express Tribune, January 25th, 2015.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ