Weekly review: Political unrest, oil prices drag index down by 297 points

Sukuk placement, low inflation expectations only positives in a bearish week

The stock market’s upward drive came to a screeching halt as increasing political unrest and declining oil prices took their toll, pulling the benchmark KSE-100 index down by 297 points (0.9%) during the week ended November 28.

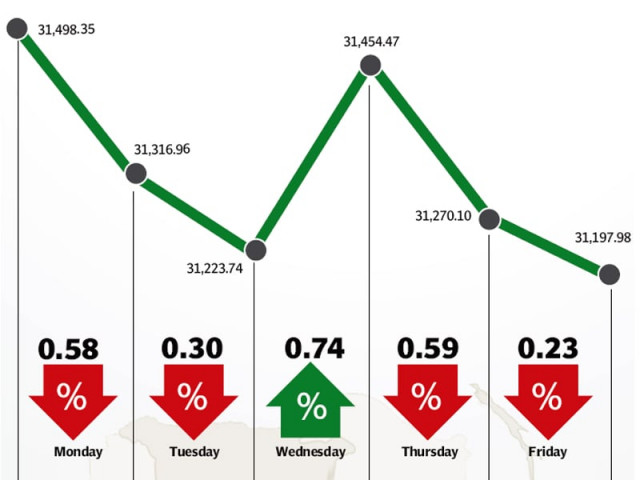

After closing at an all-time high at the end of the previous week, the index closed in the red in four out of the five trading sessions of the week to close at 31,198 points on Friday. The government’s successful Sukuk placement and expectations of low inflation numbers for the month of November were the only positive of the week.

Political tension again reached fever pitch with the opposition Pakistan Tehreek-e-Insaf all set to hold a massive political rally in Islamabad against the incumbent government and demanding electoral reforms. The PTI’s sit-in at Islamabad has lasted more than 100 days now and the weekend gathering is aimed at bringing attention to rigging in the elections of 2013.

With uncertainty lingering on, investors chose to take a backseat and engaged in profit-taking during most of the week. The situation was made worse with the continuing decline in global oil prices which took its toll on the heavyweight oil and gas sector.

During the week, the Organisation of the Petroleum Exporting Countries (OPEC) announced that it would not cut production in the face of lower demand, which resulted in crude oil prices falling to $71 per barrel. The news hit the oil and gas sector badly as OGDC, PPL and POL all fell by 8%, 6% and 6% respectively during the week.

Further bad news came in the form of foreigners turning into net sellers again and offloading a net of $4.5 million worth of equity as compared to net buying of $4.8 million in the previous week.

All news was not bad news however as during the week, the government successfully conducted the issuance of Sukuks to raise $1 billion to shore up foreign exchange reserves. Due to an overwhelming response, the government managed to issue the 5-year Sukuks at a return of 6.75% as opposed to the initial target of 6.875%.

Further positivity came, ironically, from the declining oil prices which have resulted in inflation falling sharply in the past few months. Inflation for the month of November, which will be announced in the coming week, is expected at under 5% and will likely raise expectations of a further discount rate cut in the monetary policy announcement in January.

In sector-specific news, the fertiliser sector was in the spotlight as urea off-take numbers for the month of October clocked in 14% lower year-on-year. However, that did not impact Engro Corporation, which rose 8.1% during the week as it continues to aggressively pay off its debts and also expected to conduct a secondary offering of its subsidiary Engro Fertilizers.

Average trading volumes fell 19.3% and stood at 209 million shares traded per day. Average daily values also fell 25.8% and stood at Rs11.21 billion per day. The KSE’s market capitalisation stood at Rs7.15 trillion at the end of the week.

Winners of the week

Sui Northern Gas Pipelines

Sui Northern Gas Pipelines Limited purchases, purifies, transmits, distributes, and supplies natural gas, in addition to marketing Liquefied Petroleum Gas.

Engro Corporation

Engro Corporation Limited manufactures and markets fertilisers and plastics, generates electricity, and processes food. The company produces nitrogenous, phosphatic and blended fertilizers, polyvinyl chloride resin, and industrial automation products, develops electricity generating plants, produces dairy foods, and operates a liquefied petroleum gas and liquid chemical terminal.

Maple Leaf Cement

Maple Leaf Cement Factory Limited produces and sells cement products in Pakistan.

Losers of the week

Hum Network Limited

Hum Network Limited operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Oil and Gas Development Company

Oil and Gas Development Company Limited explores and develops oil and natural gas properties in Pakistan.

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Published in The Express Tribune, November 30th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ