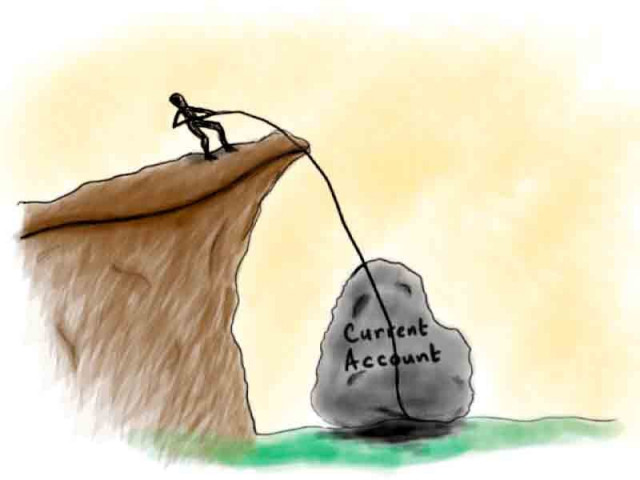

Net borrower: Current account deficit clocks in at $1.7 billion

Stands at 1.8% of GDP, widens $391m compared to last year.

Pakistan’s current account deficit in the first four months of 2014-15 remained $1.7 billion, according to data released by the State Bank of Pakistan (SBP) on Wednesday.

The current account deficit widened $391 million in July-October compared to the same four-month period of the preceding fiscal year when it was $1.36 billion.

A deficit/surplus reflects whether a country is a net borrower/lender of capital with respect to the rest of the world.

As a percentage of the gross domestic product (GDP), the current account deficit stood at 1.8% in July-October as opposed to 1.7% in the same period of the last fiscal year.

In October alone, the current account balance clocked up at $347 million. Last month, the SBP had reported a current account surplus of $3 million for the month of September. However, the revised data says the country had a current account deficit of $79 million in September.

Increasing imports and decreasing exports have widened Pakistan’s current account deficit during the first four months of 2014-15. Pakistan exported goods worth over $8 billion in July-October as opposed to exports of goods totalling $8.34 billion in the comparable months of 2013-14, reflecting a year-on-year decrease of 3.3%.

The value of goods exported in October decreased by $105 million on a month-on-month basis to $2.09 billion, which is 4.8% less than the exports of $2.19 billion recorded in September.

Pakistan’s total imports of goods in July-October were $15.5 billion as opposed to $14.1 billion in the comparable period of 2013-14, which means an annual increase of 9.5%. On a month-on-month basis, however, the value of goods imported decreased 9.3%, as Pakistan imported goods worth $3.6 billion in October.

The balance of trade in both goods and services at the end of the first four months of 2014-15 clocked up at -$8.1 billion as opposed to the deficit of $6.7 billion recorded in the same period of the preceding fiscal year. Workers’ remittances remained $6.07 billion in July-October, up 15.2% from the same four months of the last fiscal year when they totalled $5.2 billion. Workers’ remittances in October clocked up at $1.3 billion, registering a decline of almost 20% on a month-on-month basis.

The country’s balance of payment (BoP) position weakened in 2013-14, as foreign exchange reserves held by the central bank decreased to only $2.8 billion in February.

With an import cover for less than a month, a low level of foreign exchange reserves prompted federal authorities to force exporters to bring their dollar-denominated revenues into the rupees before the stipulated limit of 120 days.

SBP-held reserves improved following alleged intervention from policymakers into the foreign exchange market, resulting in a year-on-year increase of more than 50% by the end of the fiscal year in June. SBP-held reserves currently stand at $8.4 billion.

Published in The Express Tribune, November 20th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ