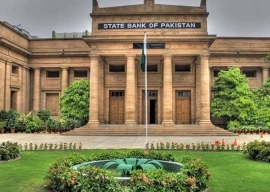

Pakistan’s current account deficit in the first three months of 2014-15 remained $1.33 billion, according to data released by the State Bank of Pakistan (SBP) on Monday.

The current account deficit widened by $62 million in July-September over the same three-month period of the preceding fiscal year when it was $1.26 billion.

With the difference of exports and imports being the biggest determinant of the current account balance, a deficit or surplus reflects whether a country is a net borrower or lender with respect to the rest of the world.

As a percentage of the gross domestic product (GDP), the current account deficit stood at 1.8% in July-September as opposed to 2.1% in the same period of the last fiscal year.

In September alone, the current account balance clocked up in the positive territory with a surplus of $3 million. In contrast, it was negative in August with a deficit of $560 million.

Increasing imports and decreasing exports have put the country’s current account balance under pressure during the first quarter of 2014-15.

Pakistan exported goods worth $5.96 billion in July-September as opposed to exports totaling $6.27 billion in the comparable months of 2013-14, reflecting a year-on-year decrease of over 5%.

The value of goods exported in September increased by $288 million on a month-on-month basis to $2.17 billion, which is 15.27% higher than the exports of $1.88 billion recorded in August.

Pakistan’s total imports of goods in July-September were $11.82 billion as opposed to $10.57 billion in the comparable period of 2013-14, which means an annual increase of 11.78%.

On a month-on-month basis, however, the value of goods imported remained almost flat, as Pakistan imported goods valuing $3.91 billion in September.

Balance of trade in both goods and services at the end of the first quarter of 2014-15 clocked up at -$6.3 billion as opposed to the deficit of $5.19 billion recorded in the same period of the preceding fiscal year.

Workers’ remittances remained $4.69 billion in July-September, up 19.5% from the same three months of the last fiscal year when they totaled $3.92 billion. Workers’ remittances in September increased $768 million from the preceding month, registering a rise of almost 30% on a month-on-month basis.

The country’s balance of payment (BoP) position weakened in 2013-14, as foreign exchange reserves held by the central bank decreased to only $2.8 billion in February.

With an import cover for less than a month, a low level of foreign exchange reserves prompted federal authorities to force exporters to bring their dollar-denominated revenues into the rupees before the stipulated limit of 120 days.

SBP-held reserves improved following alleged intervention from policymakers into the foreign exchange market, resulting in a year-on-year increase of more than 50% by the end of the fiscal year in June. SBP-held reserves currently stand at $8.8 billion.

Published in The Express Tribune, October 21st, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1730706072-0/Copy-of-Untitled-(2)1730706072-0-270x192.webp)

@Hassan: Then end the dharnas, and stop giving them an excuse!

Sure, Blame it on dhernas .. the easiest way out