Market watch: Index ends just shy of 30,000

Benchmark KSE-100 index rises 270 points.

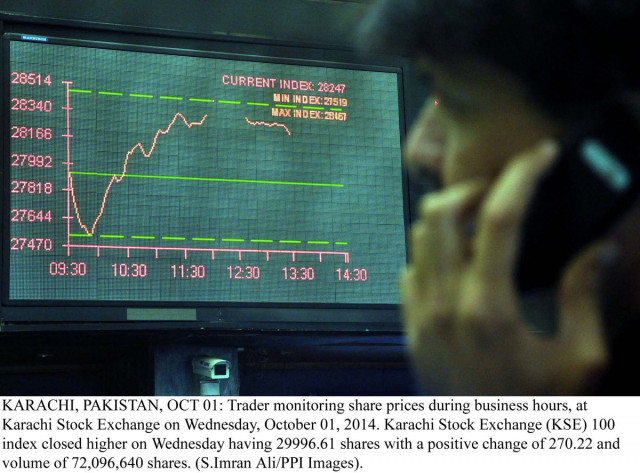

At close, the Karachi Stock Exchange’s (KSE) benchmark 100-share index rose 0.91% or 270.22 points to end at 29,996.61.

Elixir Securities analyst Mohammad Zain said turnover picked up steadily on institutional buying, mainly in OMCs and cements with Pakistan State Oil (PSO +2.26%), Lucky Cement (LUCK +3.42%) and Pioneer Cement (PIOC +2.93%) driving the index to re-test the 30,000 barrier.

“Furthermore, Oil and Gas Development Company (OGDC) managed to hold its recent lows as official road show starts up for GDS offering,” said Zain.

“It’s being speculated that floor price will be near Rs240 per share. Official floor price will be announced post next week after Eid holidays.”

The analyst further predicted the stance to remain positive and expected interest and turnover to improve after Eidul Azha, anticipating an advance in the index to the levels of 30,600 to 30,800.

“Local investors were encouraged by the fact that foreigners turned net buyers after a short spurt of selling ended,” said JS Global analyst Irfan Iqbal. “High levels of cash held by local business groups, low fixed income instrument yields coupled with foreign institutional interest are being seen as a reason for the resilience of the market despite political uncertainties.”

Trade volumes rose to 125 million shares compared to Tuesday’s tally of 100 million.

Shares of 392 companies were traded on Wednesday. Of these, 152 companies declined, 216 closed higher while 24 remained unchanged. The value of shares traded during the day was Rs7 billion.

Dewan Motors was the volume leader with 10.4 million shares, gaining Rs1 to close at Rs7.66. It was followed by Lafarge Pakistan with 8.7 million shares, gaining Rs0.10 to close at Rs16.61 and DGK Cement with 7 million shares, losing Rs0.90 to close at Rs78.80.

Foreign institutional investors were net buyers of Rs650 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, October 2nd, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ