Weekly review: KSE-100 falls below 30,000, investors exercise caution

OGDC offering, GIDC imposition and limited foreign buying main factors behind the decline.

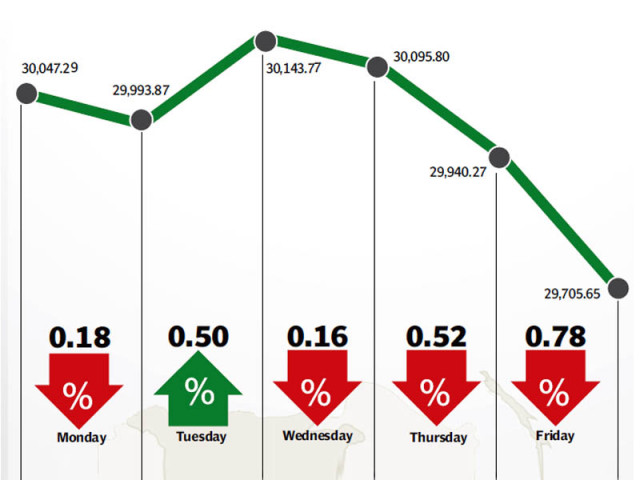

The KSE-100 index failed to sustain its level above the 30,000-point barrier as lack of triggers and limited foreign interest took toll on the benchmark index which fell 310 points (1%) to 29,705 during the week ended September 26.

The market looked shaky throughout the week and dipped below the 30,000 point barrier on several occasions before closing at 29,705 points on Friday, firmly below the psychological barrier. The index closed in the red in all but one trading sessions of the week.

Lack of triggers amid growing political tension along with mixed corporate results and declining foreign buying were the major causes of the index’s decline. Details about the Oil and Gas Development Company’s secondary public offering also played a major role in the index’s decline with OGDC alone slashing 117 points off the KSE-100 index.

The political situation showed no signs of coming to an end as the Pakistan Tehreek-e-Insaf (PTI) hosted a massive rally in Karachi over the weekend, highlighting popular support for the protests. However, the government remained apathetic towards the protests with the prime minister taking off for New York to attend the United Nations General Assembly summit.

The State Bank of Pakistan also announced the monetary policy, for the next two months, over the previous weekend and kept the discount rate unchanged at 10%, resulting in a collective yawn from the market as the decision was widely expected. During the week, several events took place, all of which had a negative impact on the bourse. First was the emergence of details about the OGDC’s secondary public offering. The government intends to offload 323 million ordinary shares of the company in a bid to raise $815 million, the largest offering of a government-owned company in eight years.

Investors were left largely concerned by the announcement as rumours spread that the offering will be at a significant discount to the prevailing market price of the company’s stock. As a result, the share fell 3.8% during the week and knocked off 117 points from the KSE-100 index.

The next major news came from the government which decided to give legal cover to the Gas Infrastructure Development Cess by issuing a presidential ordinance. The government will collect Rs145 billion through the imposition of GIDC, which will have a negative impact on earnings of gas-utilising industries such as fertiliser and textiles.

To make matters worse, foreign buying took a sharp dip and was recorded at only $0.3 million as compared to $13.2 million in the previous week. It was a second week in succession that foreign buying declined and will be a cause of concern for investors going forward.

Average trading volumes fell by 5.5% and stood at 154.6 million shares traded per day, while average daily values rose eight percent and were recorded at Rs8.37 billion. The KSE’s market capitalisation stood at Rs6.92 trillion at the end of the week.

Winners of the week

Archroma Pakistan Limited

Archroma Pakistan Limited manufactures and sells chemicals, dyestuffs, and emulsions worldwide. It provides special chemicals for sizing, fibre finish, pre-treatment, dyeing, printing, and finishing of textiles; and optical brighteners and chemicals for functional treatment of technical textiles.

Mari Petroleum Company Ltd

Mari Petroleum Company Limited specialises in the drilling, production and selling of natural gas.

Pakistan Cables

Pakistan Cables Limited manufactures and distributes copper rods, wires, cables and conductors, aluminium profiles and anodised fabrications.

Losers of the week

Cherat Cement

Cherat Cement Company Limited manufactures and sells cement and clinker.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Attock Cement

Attock Cement Pakistan Limited manufactures and sells cement and related products. The company is also part of the Pharaon group, which in addition to investments in the cement industry also owns interests in the oil and gas sector.

Published in The Express Tribune, September 28th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ