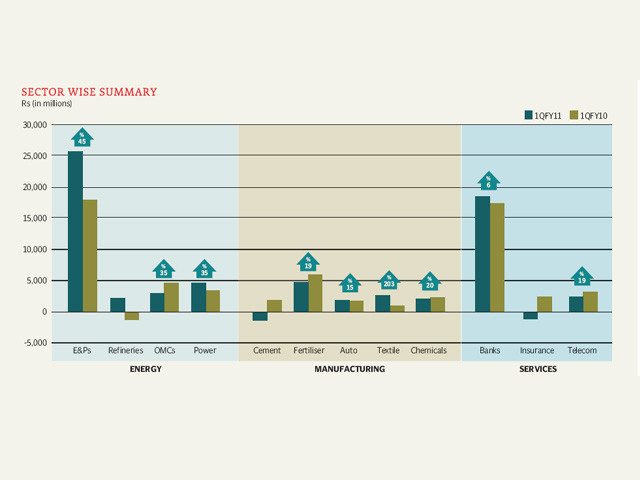

Corporate profits rise 13% led by energy firms

Corporate profits surged to Rs62 billion during the quarter ended September 30 from last year’s Rs55 billion.

The KSE-100 posted a return of six per cent in October with increased activity following company results. The refreshing facet was enhanced involvement of local investors, which improved average daily volumes by 76 per cent on a monthly basis to 107 million shares, according to JS Global Capital.

Corporate profits surged to Rs62 billion during the quarter ended September 30 from last year’s Rs55 billion, said JS Global Capital analyst Syed Atif Zafar who reached this conclusion after evaluating 40 companies, 76 per cent of the KSE-100 market capitalisation.

Energy: the frontrunner

Energy companies recorded an impressive earnings growth of 41 per cent on a yearly basis, largely driven by a 45 per cent growth in exploration and production companies and 35 per cent rise in profits of power utilities.

Manufacturing: flood hit

With domestic demand taking a major hit because of the recent floods, earnings of the manufacturing sector fell by 33 per cent on a yearly basis.

Cement dispatches and fertiliser offtake declined by 18 per cent and 30 per cent on a yearly basis following the floods.

However, textile companies made hay and saw profits surge by 203 per cent due to improved margins on the back of low-priced cotton stock available from last year, said Zafar in the company research report.

Services

The banking sector’s profits improved by six per cent due to higher net interest income and lower provisioning expense. However, Adamjee Insurance earnings declined substantially due to the absence of a reversal of impairment charges and lower investment income, said Zafar. Hence, overall services sector earnings were down 6 per cent.

Published in The Express Tribune, November 2nd, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ