Current account deficit over $2.1 billion, data reveals

Widens to 1.2% of GDP in July-March.

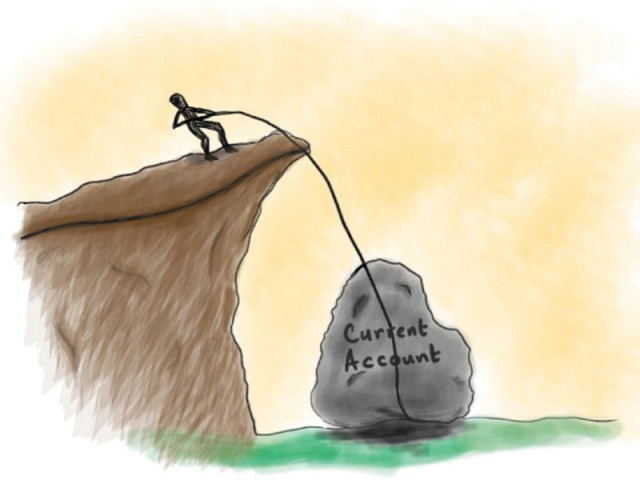

The current account balance for March remained a negative $156 million. DESIGN: MUNIRA ABBAS

The current account balance for March remained a negative $156 million. In contrast, the current account in February was in surplus ($167 million), the SBP data shows.

Shown as a percentage of the gross domestic product (GDP), the current account deficit widened to 1.2% in July-March as opposed to 0.7% in the same period of the last fiscal year.

The country’s balance of payment (BoP) position was particularly vulnerable until recently mainly because foreign exchange reserves held by the central bank had declined to a critical level of $2.8 billion on February 7. This meant that the reserves provided less than one month of import cover. However, SBP-held foreign exchange reserves have now increased to $6.9 billion, up 146% in a little over two months.

Pakistan exported goods worth $2.1 billion in March as opposed to exports totaling $2 billion in the preceding month, reflecting a month-on-month increase of 5%. For the July-March period, exports increased to $18.9 billion, up 3.2% from $18.3 billion recorded in the corresponding nine-month period of 2012-13.

The country’s total imports of goods in March were $3.3 billion as opposed to $3.1 billion in January, which means an increase of 7.3% in one month. For the July-March period, imports increased to $31 billion, up 3.6% from $29.9 billion in the corresponding nine-month period in 2012-13.

Workers’ remittances remained $1.3 billion in March, up 10.5% from the preceding month. Workers’ remittances in July-March increased to $11.5 billion, registering an increase of 11.6% over the corresponding nine-month period in the preceding fiscal year when they totaled $10.3 billion.

A less-than-favourable current account balance in the last month can partially be attributed to a decline in foreign investment flows. Pakistan received Foreign Direct Investment (FDI) of $669.8 million in the first nine months of 2013-14, up 6.14% from the corresponding nine-month period of the preceding fiscal year.

Just like the current account posted a deficit in March, as opposed to a surplus in February, FDI also recorded a sharp increase in February only to drop significantly during March. FDI remained $63.5 million in March, 45.6% less than $116.8 million recorded in the same month of the preceding fiscal year.

Published in The Express Tribune, April 18th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ