Stocks march forward on company earnings

Stock prices continue to rise at country’s biggest equity market as investors react favorably to corporate results.

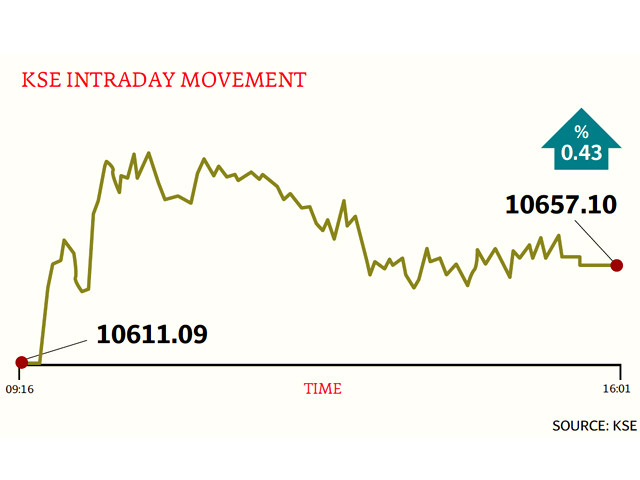

The benchmark KSE-100 index rose 46 points to end the day at 10,704 but not before rising as high as 10,758 points during intra-day trade.

The positive trend in the day’s activity was because of the announcement of corporate results, said Ahsan Mehanti, director at Arif Habib Investments.

“Better-than-expected earnings in the power sector and the expectation of an early approval of leverage products kept investor sentiment positive throughout the trading session despite concerns over growing economic uncertainty and the circular debt in power sector,” said Mehanti.

“Pakistan’s delegation is expected to meet with the International Monetary Fund to discuss the next tranche and investors are hopeful of a positive development on that front also,” he added.

Volume of shares traded stood at 142 million compared with 150 million traded on Tuesday. Analysts highlighted that trading interest has been revived since the onset of result announcements early last week. The value of shares traded was Rs4.19 billion.

During the day, Nishat Power led in terms of volumes with 20 million shares changing hands while National Bank and Lotte Pakistan also witnessed exchanges of over 13 million shares each.

The broader market witnessed activity in shares of 385 companies. Of these, 192 advanced, 163 declined and 30 remained unchanged.

Topline Securities analyst Samar Iqbal highlighted that “investors were drawn to OGDCL once again on the back of the company’s interest in the assets of British Petroleum Pakistan.”

However, she added that the current spike in investor activity will probably abate once all major corporate results for the outgoing quarter are announced. “Going forward, the approval of the margin trading system and the IMF’s tranche to the country will be key triggers that will determine the market trend in coming sessions,” she added.

Published in The Express Tribune, October 28th, 2010.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ