Growing: Textile industry stitches impressive growth rate

Strengthening exports, stable margins boost revenue.

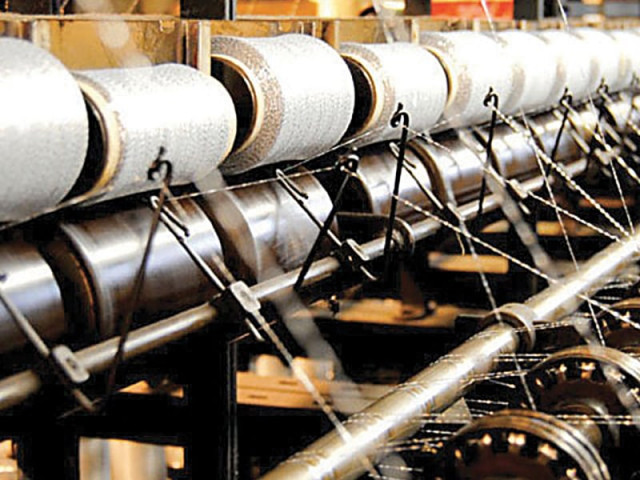

Rupee appreciation, less orders from China, dumping of Indian yarn and 2%-17% tax on textile exports may exert pressure on textile sector in the coming months. PHOTO:FILE

According to a report compiled by Topline Securities, growth in the industry was witnessed because of improved demand and stable yarn margins, while a depreciating rupee (the rupee fell 7% against the dollar in 1HFY14) and declining finance costs managed to boost revenue.

The brokerage house’s analysis is based on listed textile companies (78 firms) which includes all textile units below Rs250-million market capitalisation at the Karachi Stock Exchange (KSE). However, for the sake of comparability, Azgard Nine and Amtex Limited have been omitted due to volatility in their net profits.

Profits of the sample textile firms increased by 26% to reach Rs17.5 billion while gross profits posted a growth of 14% to Rs39 billion in 1HFY14. Net profits grew more than gross profits mainly because of the decline in financial charges.

Though the sample covers 60% of textile sector market capitalisation, it is very small compared to the total Pakistan textile industry. Therefore, actual profit growth of the textile industry would be much more than Rs3.6 billion. The same was also reflected at the local bourse as shares of companies in the sample gained 53% against the benchmark KSE 100-Index’s return of 20% in 1HFY14.

Sales up 7% led by exports

Overall textile output in 1HFY14 jumped by 6.8% due to the uptick in sales of the sample companies to Rs283 billion. This can also be observed from 7.8% growth in the country’s total textile exports for the period to $6.9 billion. In terms of Pakistan rupee, overall textile exports went up 19% year on year (YoY) to Rs730 billion.

Strong cotton yarn, grey cloth and bed wear demand from China and neighbouring countries has contributed to higher units sales, while margins increased due to stable cotton prices and around 7% Pak rupee depreciation against the dollar in the same period.

In 1HFY14, local cotton prices remained in the range of Rs6,806-7,771 per 40kg compared to Rs5,573-6,645 in 1HFY13, depicting less volatility this time.

2QFY14 was not good

The textile sector performed well in 1QFY14 but profits declined slightly by 0.3% quarter to quarter (QoQ) in 2QFY14 due to a massive surge in fuel and power cost and less textile exports in second quarter of the current fiscal year.

Exports of textile products decreased by 5% QoQ to $3.4 billion compared to $3.6 billion in 1QFY14. A major decline can be seen in cotton yarn followed by bed wear, which decreased by 18% QoQ and 12% QoQ, respectively.

However, rupee depreciation by almost 4% QoQ during the period provided some support to the companies’ falling profits.

Outlook for 2HFY14

The recent rupee appreciation, relatively less orders from China, dumping of Indian yarn in the country and materialisation of proposed 2%-17% tax on textile exports may exert pressure on profits of textile sector in coming months, the report forecast.

However, the recently-awarded Generalised System Preference (GSP) Plus status from the European Union (EU) and resultant surge in local demand will likely ease-off this pressure to some extent.

Published in The Express Tribune, March 14th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1724319076-0/Untitled-design-(5)1724319076-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ