Market watch: Stocks slip as investors stay cautious

Benchmark KSE-100 index falls 14 points.

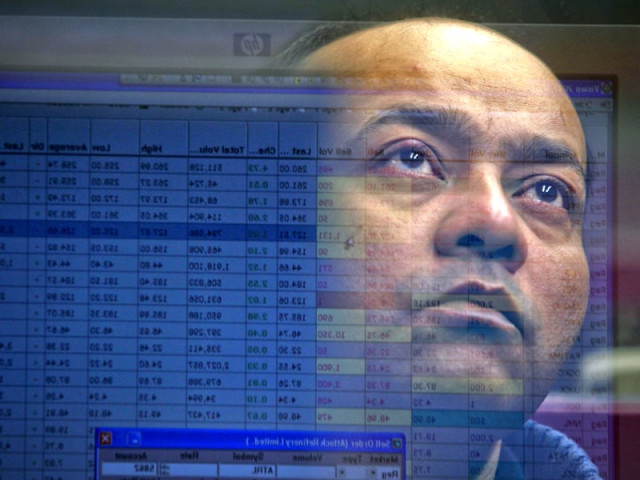

Allied Bank reported a 24% jump in annual earnings as the bank availed tax benefits of Rs4 billion accumulated from previous years. PHOTO: FILE

At the close, the Karachi Stock Exchange’s (KSE) benchmark 100-share index fell 0.06% or 14.8 points to end at 26,240.41.

“With earnings excitement failing to keep investors hooked, there was an overall selling mood across the board as investors chose to trim positions in the wake of uncertainty after a steep fall on Monday,” said Jawwad Aboobakar of Elixir Securities.

Most oil, financial and cement (stocks) contributed to the decline, which included Lucky Cement (-0.23%), DG Khan Cement (-0.46%), Pakistan Oil Fields (-0.18%), United Bank (-0.44%) and Pakistan State Oil (-0.13%).

However, late buying, especially in Engro Corporation (+1.63%), Engro Fertilizers (+5%), Fatima Fertilizer (+1.37%) and Dawood Hercules (+3.06%), pulled back the index from 26,108 points to close above 26,200.

“The market closed marginally in the red zone as the downward momentum kept the bulls in a cautious mood,” said Ovais Ahsan, a market analyst at JS Global. “The banking sector kicked off the full-year results season as MCB Bank (-1.2%) reported lower-than-expected earnings, driving the index down.”

The Engro group continued to charm investors as Engro Fertilizers hit the ceiling on optimism, following its first analyst briefing, that the company would receive gas at the concessionary rate of 70 cents. Engro Corporation rallied on the strength of its fertiliser subsidiary.

Allied Bank reported a 24% jump in annual earnings as the bank availed tax benefits of Rs4 billion accumulated from previous years.

“The market should resume upward momentum as selling from local mutual funds following a large redemption from a government pension fund exhausted. The ongoing result season should also invite volumes in top-tier names,” the analyst said.

Trade volumes dropped to 222 million shares compared with Monday’s tally of 287 million.

Shares of 393 companies were traded. At the end of the day, 167 stocks closed higher, 209 declined and 17 remained unchanged. The value of shares traded during the day was Rs6.1 billion.

Jahangir Siddiqui and Company remained the volume leader with 40.8 million shares losing Rs0.83 to finish at Rs12.8. It was followed by Lafarge Pakistan with 19.6 million shares gaining Rs0.73 to close at Rs10.97 and Engro Fertilizers with 11.46 million shares gaining Rs2.18 to close at Rs51.46.

Foreign institutional investors were net sellers of Rs13.1 million worth of shares, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, February 12th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ