Weekly review: Volatile week ends with KSE down 102 points

Investors remained cautious in the face of positive inflation figures.

Investors remained cautious in the face of positive inflation figures.

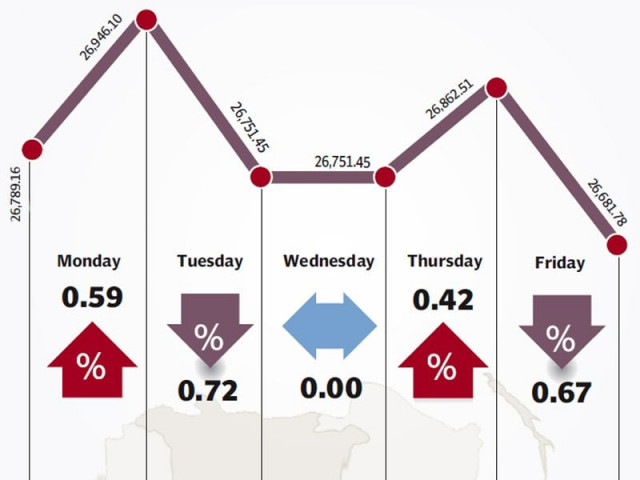

A volatile week came to an end at the stock market with the benchmark KSE-100 index falling 102 points (0.4%) despite the ongoing earnings season and positive inflation figures for the month of January.

After a positive start on Monday, the index closed negative on Tuesday and repeated the pattern in the remaining two trading days of the week to close at 26,681 points on Friday. There was no trading on Wednesday due to the Kashmir Day holiday.

The biggest contributor to the market’s decline was the 16% slump in Nestle Pakistan’s share price. If the impact of Nestle’s decline was excluded, the index would have closed flat for the week, according to a report of Elixir Securities.

The highlight of the week was the release of inflation figures for January. CPI inflation rose only 7.9% year-on-year and was a pleasant surprise for investors.

After peaking at 10.9% in November 2013, inflation softened to 9.2% in December and 7.9% in January.

The low inflation for December was instrumental in encouraging the State Bank of Pakistan not to increase the discount rate in its monetary policy announcement in January and the lower figure for January will create optimism in the market for a potential rate cut in the next policy which will be unveiled in March.

The results season also continued in full swing with Pakistan Telecommunications Company Limited (PTCL) and Engro Fertilizers announcing their earnings for the year ended 2013. PTCL posted a healthy growth of 97% over 2012 with earnings per share of Rs3.09 and a payout of Rs1 per share.

Engro Fertilizers also posted solid growth in its first post-IPO earnings announcement with EPS of Rs4.24 per share for 2013 compared to a loss per share of Rs2.55 in 2012. Its share closed at its upper circuit breaker following the results.

Foreigners continued to be buyers at the bourse with net buying of $6.9 million for the week, up from $2.3 million in the previous week. The improved numbers alleviated fears of local investors about foreign capital flight due to the ongoing turmoil in regional markets.

The country’s foreign exchange reserves posted a slight improvement of $23.5 million and stood at $8.02 billion, according to latest figures of the central bank. The figure should improve further next week as the United States releases $352 million under the Coalition Support Fund.

Average trading volumes dropped slightly by 5.3% and stood at 283.5 million shares per day. Average daily value remained steady at Rs8.91 billion, as second and third-tier stocks dominated the volume charts. The market capitalisation fell 1.9% and stood at Rs6.48 trillion at the end of the week.

Winners of the week

Grays of Cambridge

Grays of Cambridge (Pakistan) Limited is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

Feroze1888

Feroze1888 is a manufacturer and an exporter of specialised yarn and textile terry products in Pakistan.

Jahangir Siddiqui and Company

Jahangir Siddiqui Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Losers of the week

Nestle Pakistan Limited

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Azgard Nine

Azgard Nine Limited manufactures and exports textile products such as denim fabrics, and apparel. The Company also manufactures and sells urea and phosphatic fertilisers from its fertiliser plants.

Published in The Express Tribune, February 9th, 2014.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ