Ishaq Dar calls for public shaming of tax evaders

Urges business community to accept publication of tax directories with open mind.

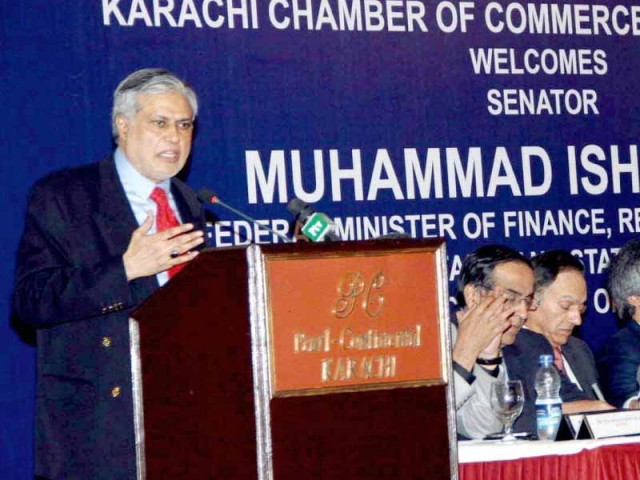

Dar promised Karachi’s business community a ‘major surgery of the country’s economy’ at an inauguration ceremony on Wednesday. PHOTO: PPI

Finance Minister Ishaq Dar on Wednesday urged the country’s business community to stop opposing the publication of a tax directory.

Flatly refusing one of Karachi Chamber of Commerce and Industry’s (KCCI) major demands, Dar said, “You all should accept it with an open mind and let tax thieves get embarrassed.”

In his address to KCCI members in Karachi, the minister also said that the tax directory of parliamentarians and the directory of businessmen were due to be published by January 31 and February 15, respectively.

“The world community mocks Pakistan for non-transparent collection of taxes from businessmen and parliamentarians, so let’s do something transparent once and for all,” Dar said, adding that it was the government’s responsibility to identify tax defaulters.

“The government must make public a list that identifies those who are not even in the tax net of the Federal Board of Revenue (FBR),” the minister urged. However, he said the directory will only contain the names and National Tax Numbers (NTN) of the businessmen and not the details of their assets.

Ailing economy

The minister praised the performance of his government during the six-month period on the economic front and said, “We will perform a major surgery of the country’s economy,” which he cautioned, was going to hurt the nation and the business community in the short run.

“This surgery will be painful because the structural problems of the country cannot be treated with aspirin,” the minister stressed.

Defending the government’s move to approach the IMF, Dar said, “Taking loans for development is not bad, taking loans just for the sake of expenditures is bad.”

He also assured the business community that the government would keep its word on building $20 billion foreign reserves in three years, expanding the tax net, reducing budget deficit, and providing an enabling environment for the business community.

On the Thar Coal project, he said the federal government wanted to support the Sindh government and that the prime minister will soon convene a meeting of all important stakeholders to increase the pace of development work on the project.

Appreciating KCCI’s idea of setting up special economic zones, Dar said the federal government was ready to support the initiative to make most of the GSP-Plus status, recently granted by the European Union (EU).

Karachi Operation to continue

The minister assured businessmen that the centre will continue to support the provincial government on all security issues, including the ongoing Karachi operation.

The KCCI leadership had sought assurance from the federal government on the continuation of the Karachi operation, which was reportedly being discontinued for an unannounced period. Sindh Rangers and top businessmen have recently opposed any expected reshuffle in Sindh police after the killing of SP Chaudhry Aslam.

Published in The Express Tribune, January 16th, 2014.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ