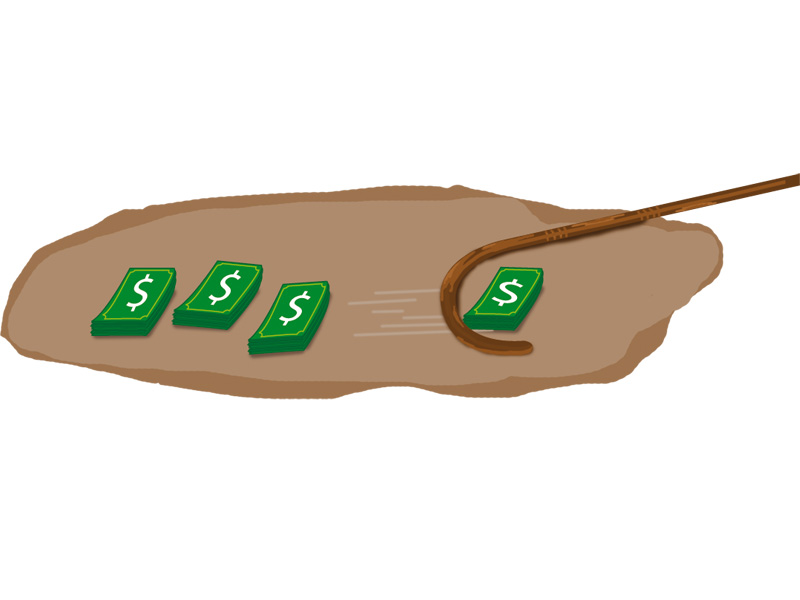

About one-fourth or $100 million of a $430 million loan that the government has borrowed to disburse among the poor, will never reach the downtrodden, as this significant chunk has been set aside for other purposes such as consultancy services, according to the loan agreement.

The government has recently signed an agreement with the Asian Development Bank (ADB) for obtaining the $430 million loan to distribute as monthly cash stipends under the Benazir Income Support Programme (BISP). With the stipend of Rs1,200 per month, total cash payment will be about $335 million.

The agreement was inked last month amid apprehensions of misuse of money, as the ADB had already traced Rs2.1 billion of payments that did not reach eligible beneficiaries out of a loan that it gave for the BISP.

The new loan carries the conditions that Pakistan will conduct a strict audit and return Rs2.1 billion that the previous PPP government had disbursed among ineligible people.

The government will return the loan in 25 years along with interest payment at the rate of 2% in dollar terms.

The PML-N government has promised to expand the outreach of the programme to 5.4 million families and allocated Rs75 billion for the current financial year.

An amount of $14.6 million or 3.4% of the loan has been placed under the head of ‘contingencies’. It will be spent on field surveys, research and development and conducting studies, according to BISP officials.

Another $16.7 million or 4% would be spent on consultancy services as consultants would be hired to review the design of BISP cash transfers, Waseela-e-Rozgar and Waseela-e-Sehat programmes, the officials said.

The third component of $24.4 million or 5.7% of the loan has been set aside to pay “interest charges”. However, it is not clear on what account the interest charges will be paid. The cost of interest of a loan is usually added to the project cost only in case of infrastructure projects.

Another $40.2 million or about one-tenth of the loan has been placed under the category of performance allocation. According to BISP officials, the fate of this allocation will be decided after the first mid-term project review, scheduled for 2016.

They added if the progress on Waseela-e-Rozgar and Waseela-e-Sehat programmes remained satisfactory, the amount would be released accordingly.

Apart from these, $1.5 million will be spent on transportation, training workshops and procurement of equipment. However, the tasks could have been performed by utilising domestic resources to keep foreign debt at a lower level.

According to ADB laws, any amount spent on other than the indicated purposes come under the category of “mis-procurement” or “misuse”.

In order to minimise chances of misuse, the ADB has attached the condition that the BISP board will constitute an audit committee to oversee financial reporting and audit of the BISP and will review internal audit reports. The committee will include a non-government member.

The BISP is also bound to provide its unaudited and audited financial statements to the ADB and provide an action plan to address the deficiencies identified in the audit.

The government must satisfy the ADB that in future no payments to ineligible beneficiaries will be made, as the bank has detected irregular payments in the past.

A report of the Auditor General of Pakistan indicated that there were some payments made to ineligible beneficiaries and the lending agency had given Pakistan three years to return this money or it would deduct Rs2.1 billion from the fresh loan, according to the loan agreement.

Published in The Express Tribune, December 21st, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ