Weekly review: KSE-100 jumps 2.4% on minimal discount-rate hike

Investors positively surprised after SBP raised rate by only 50 basis points.

Investors positively surprised after SBP raised rate by only 50 basis points.

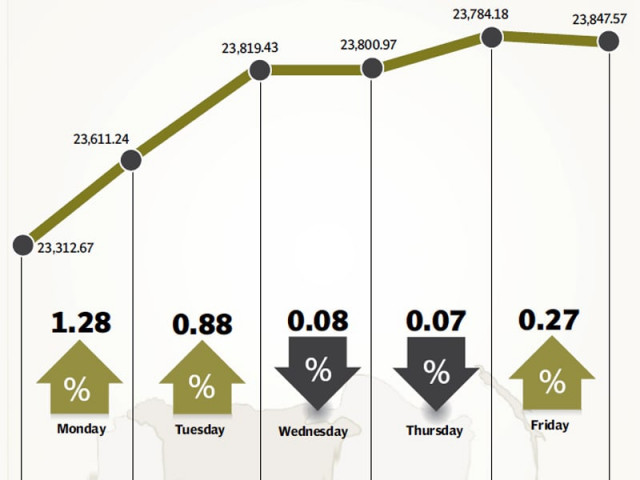

The stock market returned to its upward trend following a momentary blip last week as the benchmark KSE-100 index shot up by 560 points (2.4%) during the week ended November 22.

The market’s gain came following the State Bank of Pakistan’s decision to increase the discount rate by 50 basis points to 10% in its recent Monetary Policy Statement.

Investors were left positively surprised as there was a consensus before the announcement that the central bank would raise the discount rate by 100 basis points to 10.5%. Many investors had already priced in the higher discount rate during the previous week.

The announcement sparked an instant reaction at the bourse as the KSE-100 index climbed 324 points (1.4%) on Monday alone. By Wednesday, the index hit an all-time high of 24,000 points during intra-day trading before cooling off a bit to close the week at 23,847 on Friday.

The market’s gain was also aided by an improved current account position for the month of October, 2013 as the deficit stood at only $166 million compared to $574 million in September, 2013.

The improved position was largely due to the receipt from the Coalition Support Funds from the United States amounting to $322 million during the month.

Sector-specific news also contributed to the market’s growth. Engro Corporation’s stock garnered a lot of activity in the run-up to the potentially most anxiously-awaited IPO in recent memory of its fertilizer business, Engro Fertilizers.

The company is all set to conduct an IPO for the general public following the completion of the first phase of the IPO in which the book-building process was completed this week. The process determined the strike price of Rs28.25 per share for the IPO, which will be conducted by the end of November or in the first week of December.

The telecom sector also rejoiced the clampdown by the Pakistan Telecommunication Authority (PTA) on illegal grey traffic by blocking unregistered IPs. Resultantly, the stock of Pakistan Telecommunication Limited (PTCL) rose by 9.3% during the week.

The textile sector also continued to enjoy the positive momentum generated by the European Union’s decision to grant GSP Plus status to the country from 2014. Textile export figures for the four month period from July to October also rose 7.5% year-on-year to $4.7 billion, generating further interest in the sector.

Foreigners were again net buyers of $10.3 million worth of equity at the bourse. However, the country’s foreign exchange reserves continued to take a plunge and stood at only $8.86 billion, according to latest SBP figures.

Average trading volumes were up 10.6% and stood at 177.9 million shares traded per day. Average daily value shot up 32.9% and stood at Rs8.5 billion traded per day. The market capitalisation of the Karachi Stock Exchange stood at Rs5.68 trillion at the end of the week.

Winners of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Shifa International Hospitals Limited

Shifa International Hospitals Limited establishes and runs medical centers and hospitals in Pakistan. The company’s clinical services include medicine, pediatrics, surgical, obstetric and gynecology, dentistry, rehabilitation services and ophthalmology. Shifa also diagnostic services include specialised diagnostics, radiology and clinical laboratory.

Adamjee Insurance Company Limited

Adamjee Insurance Company Ltd underwrites insurance. The company offers fire, marine, automobile, engineering, and miscellaneous coverages. The engineering coverage includes contractor’s all risk, plant and machinery, electronic equipment and machinery insurance, and excise and customs, maintenance, and performance bonds. Miscellaneous includes health, accident, and liability.

Losers of the week

JS Bank

JS Bank is a full service commercial bank. The bank provides a wide range of banking products and services including retail and consumer, treasury, corporate and commercial, and investment banking.

Bank of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial bank services.

Askari Bank

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu and Kashmir and Bahrain.

Published in The Express Tribune, November 24th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ