Weekly review: KSE keeps upward momentum on strong corporate results

Foreign buying remains healthy, but inflation dampens investor sentiment.

Foreign buying remains healthy, but inflation dampens investor sentiment.

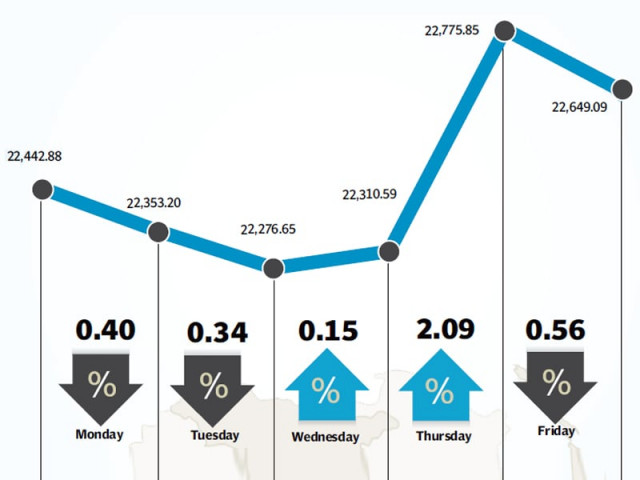

The stock market maintained its upward momentum on the back of strong corporate earnings as the benchmark KSE-100 index rose 204 points (0.9%) during the week ended November 1.

The week saw earnings announcements for several blue-chip stocks which were mostly above industry estimates and provided a platform for the index to sustain its upward drive. Foreigners also pitched in by engaging in healthy buying, aiding the index’s growth.

Mixed investor sentiment turned positive as the week trudged along and earnings above market consensus continued to pour in throughout the week. Sentiments peaked by Thursday as the index jumped up 465 points (2.1%) in a single day.

The momentum seemed set to continue until the end of the week, but the Consumer Price Index (CPI) figures, the standard measure for inflation, were revealed midday on Friday, which dampened investor sentiment leading to the index closing in the red for the day.

During the week, Pakistan State Oil (PSO) announced its results for the first quarter of the current fiscal year, posting a massive 83% growth in earnings with earnings per share of Rs31.57. This coupled with talk of an increase in oil marketing companies’ (OMC) revenues led to the company’s stock outperforming the market by 3.3%.

Similarly, the fertiliser sector was back in the limelight as resumption of regular gas supply to fertiliser plants meant a return to normal production levels, resulting in huge gains for Engro Fertilizers and Fatima Fertilizers. Fauji Fertilizer Company, which was less affected by the gas outages, also managed to post earnings above expectations, triggering buying in its stock.

Foreigners aided the index’s growth and the market saw foreign buying worth $18 million during the week. Although the number was down from last week’s $29 million, it was still considered healthy by investors and improved their sentiments.

However, an increase of 9.1% in the CPI for October did have its negative impact and the bourse ended the week with a decline in the index. As the monetary policy announcement is due later this month, it seems highly likely that the State Bank of Pakistan will take a precautionary stance and increase the discount rate, which will prove negative for the market.

The country’s foreign exchange reserves rose $267 million to $9.49 billion as per latest figures announced by the SBP. The boost came as a result of release of the Coalition Support Fund by the United States amounting to $322 million during the period.

Average trading volumes dropped 13.6% during the week and stood at 115 million shares per day. Average daily value also fell 8.5% and stood at Rs4.79 billion. The market capitalisation reached Rs5.4 trillion at the end of the week.

Winners of the week

Colgate Palmolive

Colgate-Palmolive Pakistan manufactures and sells detergents, personal hygiene, and a variety of other products.

Century Paper

Century Paper & Board Mills Limited manufactures and distributes different varieties of paper, paperboards and related products. The company also manufactures paper pulp, wood pulp.

Nestle Pakistan

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The Group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Losers of the week

JS Bank

JS Bank is a full service commercial bank. The bank provides a wide range of banking products and services including retail and consumer, treasury, corporate and commercial, and investment banking.

Jahangir Siddiqui and Company

Jahangir Siddiqui and Company is an investment company offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Netsol Technologies

NetSol Technologies Ltd provides information technology solutions and services. The company’s services include custom software development, technology outsourcing, systems integration, application development, and business intelligence consulting.

Published in The Express Tribune, November 3rd, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ