Weekly Review: Banking sector drags KSE down 302 points

Banks underperform the market by 5.6% during the week.

Banks underperform the market by 5.6% during the week.

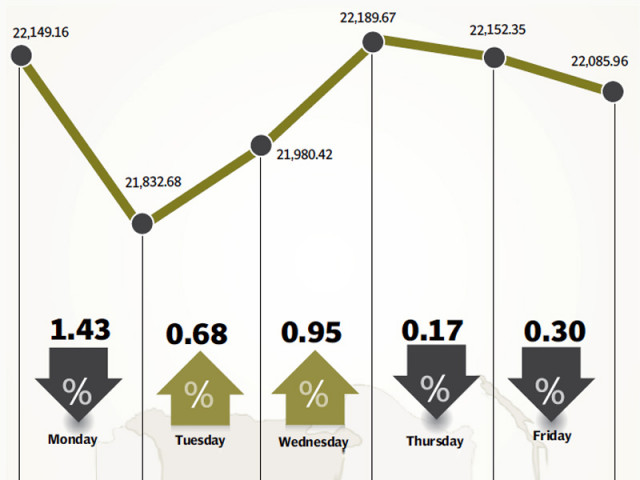

The stock market saw another torrid week as the banking sector took a battering; resulting in the benchmark KSE 100-share index falling 302 points (1.3%) during the week ended October 4.

The State Bank of Pakistan’s unexpected decision to increase the minimum deposit rate at the end of last week took its toll on the bourse and the market fell 555 points (2.5%) on the opening day of the week, with most commercial banks hitting their lower circuit breakers.

The following two days recorded minor corrections and the index regained 357 points (1.7%) before falling a further 104 points (0.5%) to close the week barely above the 22,000 barrier at 22,086 points.

Despite the midweek recovery, there was no good news for the banking sector as it underperformed the broader market by 5.6% during the week. Three of the country’s largest banks were in the list of worst performers.

United Bank Limited led the way with an overall decline of about 12% and was closely followed by Habib Bank Limited and MCB Bank Limited, which fell around 9%.

Investor activity also remained muted as average trading volumes slid 19% to 149 million shares per day. With the index at such a high level, investors chose to tread carefully, especially in the light of falling foreign currency reserves of the country.

As per latest figures from the State Bank of Pakistan, the foreign exchange reserves fell $287 million to below $10 billion. Now, the country has only $9.92 billion in its reserves and the number is likely to drop further because of debt repayments to the International Monetary Fund.

Further bad news came in the shape of rising fuel and electricity costs as the government increased prices of petroleum products and electricity tariffs for domestic consumers at the start of October.

The power tariff hike has been taken back due to intervention by the Supreme Court, however, the increase in petroleum product prices remained intact and is likely to contribute to the inflation.

Inflation numbers for September came as a surprise, clocking in at 7.4%, despite a massive electricity tariff hike for industrial and commercial consumers from August. Inflation numbers will be monitored closely by investors in coming months to make an assumption about the expected hike in discount rate by the State Bank.

The cement sector had something to cheer about as a price increase of Rs10 to Rs15 finally materialised. Lucky Cement, the country’s largest cement manufacturer, was the main beneficiary at the bourse as it outperformed the market by 3% during the week.

Despite the decline in trading volumes, average daily trading values held firm and fell only 2.5% to Rs6.01 billion. The Karachi Stock Exchange’s capitalisation slipped 1% and stood at Rs5.24 trillion at the end of the week.

Winners of the week

Hum Network Limited

Hum Network operates satellite television channels. The company operates a channel targeted primarily at women, one about food, and one that covers lifestyle and entertainment.

Century Paper

Century Paper and Board Mills Limited manufactures and distributes different varieties of paper, paperboards and related products. The company also manufactures paper pulp, wood pulp and fibrous pulp. Century Paper also has a subsidiary that is engaged in the power generation business.

National Foods

National Foods Limited is a diversified food manufacturer. The Group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of health foods.

Losers of the week

United Bank Limited

United Bank Limited provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Pak Suzuki Motors

Pak Suzuki Motor Company Limited manufactures, assembles and markets Suzuki cars, pickups, vans and 4 X 4 vehicles.

Habib Bank Limited

Habib Bank Ltd operates commercial banks in Pakistan. The bank offers commercial, corporate, investment, retail and International Group Banking.

Published in The Express Tribune, October 6th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ