Weekly Review: IMF bails out Karachi bourse from corrective spell

Index closes in the black in four out of five sessions as Washington-based lending agency approves loan.

Index closes in the black in four out of five sessions as Washington-based lending agency approves loan.

The Karachi Stock Exchange’s (KSE) corrective spell, which had been going for a couple of weeks, was held back by the approval of the $6.64 billion loan package by the International lending-based agency International Monetary Fund, providing the much-needed impetus for the bourse to close the week in the black.

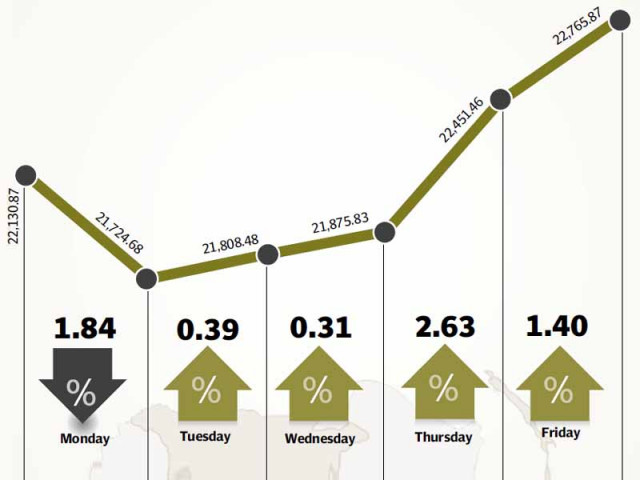

The KSE-100 index gained 605 points to close at the 22,766-point level, with average daily volumes clocking in at 194 million shares though 4.5% down over the previous week while value traded in dollars declined 5.6% during the week. Foreign investors were net sellers this week, withdrawing $1.1 million in portfolio investments.

The first trading day was the only glitch in an otherwise profitable week after two consecutive negative week closings, said a KASB Securities weekly review note. Bulls returned to the helm in dominant fashion as the KSE-100 index closed in the black in four out of the five sessions as sentiments were boosted by the approval of the extended fund facility by the IMF, emerging clarity on interest rates to some extent and concerns over the cement cartel break-up diminish.

On the macro front, inflation for August clocked in higher at 8.55% year-on-year against 8.3% in July, mainly due higher than anticipated food inflation where it touched 10.1%, hitting double-digits for the first time in 15 months.

Major earnings announcements in the week were made by DG Khan Cement and Pakistan Refinery. DG Khan Cement announced a bottom-line growth of 34% to Rs5.5 billion for the fiscal year 2012-13, while Pakistan Refinery turned its losses from 2012 to profits in 2013. Moreover, DG Khan Cement also announced its expansion plans where it plans to set up a cement facility in the south with a capacity of 2.6 million tons a year.

Other major highlights of the week were the fall in currency reserves below $10 billion, announcement of cement sale figures by the All Pakistan Cement Manufacturers Association, hike in oil prices and Supreme Court’s push for the auction of the 3G spectrum licence.

Total cement sales for the month of August declined 2% to 2.25 million tons as exports fell and local demand remained subdued due to Eid holidays, heavy rains and flooding taking decline in cement sales during the first two months of fiscal 2014 to 5% or 4.84 million tons.

The government also decided to increase the prices of petroleum products during the week up to Rs4.5 per litre effective from September 1, which is a blow to the people but great news for the oil sector.

Moreover, the Supreme Court set a 60-day deadline the 3G licence auction which will bring in some much-needed dollar inflows.

Outlook

With a handful of results still left to be unveiled, analysts expect a further slowdown in activity. Apart from global geopolitics, monetary policy statement due on September 13 and details on the terms and conditions of the IMF loan will further clarify macroeconomic scenario.

Winners of the week

Nishat Chunian

Nishat Chunian manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing, and finishing units.

PTCL

Pakistan Telecommunication Company (PTCL) provides fixed-line domestic and international telephone services, telex, telegraph, fax and leased circuit services in Pakistan. The company owns all public exchanges, the nationwide network of local telephone lines, principal long distance transmission facilities and international telephone gateways in Pakistan.

Nishat Mills

Nishat Mills is a textile manufacturing company. The company spins, combs, weaves, bleaches, dyes, prints, and buys and sells yarn, linen, other cloth, and other goods. Nishat Mill’s products and fabrics are made from raw cotton and synthetic fibre. The company also owns a power plant that generates, accumulates, distributes, and supplies electricity.

Losers of the week

Mari Gas Company

Mari Gas Company Limited specialises in the drilling, production and selling of natural gas.

Siemens Engineering

Siemens Pakistan Engineering Company Limited manufactures, installs, and sells electronic and electrical products. The company develops products for industries that include energy, industry, communications, information, transportation, healthcare, components, and lighting.

Nestle Pakistan

Nestle Pakistan Limited manufactures, imports and sells dairy products, confectioneries, culinary products and fruit juices. The Group’s products include milk, butter, cream, noodles, coffees, and dietary and infant products.

Published in The Express Tribune, September 8th, 2013.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ