The low-base effect: Investment in country dips to lowest in years

Bureaucratic red tape, uncertain environment drive investors away.

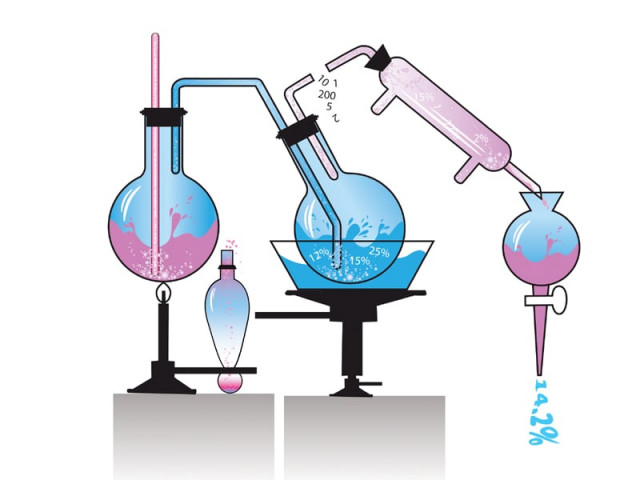

The investment-to-gross domestic product ratio stands at just 14.2% for the current fiscal year 2012-13. DESIGN: ANAM HALEEM

With bureaucratic red tape and an uncertain environment driving away private businesses, the lure of investment is certainly lacking in the economy as the investment-to-GDP ratio drops to the lowest in years.

Provisional estimates given by the Pakistan Bureau of Statistics and based on the new base year of 2005-06 show that the investment-to-gross domestic product ratio stands at just 14.2% for the current fiscal year 2012-13.

However, the numbers were not that bad few years ago. In 2008, when the Pakistan Peoples Party-led coalition government took over, the investment-to-GDP ratio was 22.5%.

In resource-scarce rich countries, economic takeoffs are strongly associated with high levels of investment, which also greatly reduces the number of unemployed, say experts.

“The 14.2% figure is rubbish, to say the least. Had the ratio been calculated on the basis of old 1999-00 base year, it would have been 11.5%,” said Dr Hafiz Pasha, a renowned economist and former finance minister.

Sounding suspicious, he asked why the economy was rebased before expected talks with the International Monetary Fund (IMF) for a new assistance programme.

For the last fiscal year, however, the statistics bureau has revised upwards the investment-to-GDP ratio to 14.9% from 12.5% following the change in the base year.

According to the estimates, private investment dipped to 8.7% of GDP this year from last year’s 9.6%, indicating that private businesses are continuously being squeezed. Contrary to this, public investment improved slightly to 3.9% from 3.7% primarily because of spending under the Public Sector Development Programme and other government expenditure.

The fixed investment ratio fell to 12.6% this year from 13.3% last year.

Though bureaucrats and politicians blame law and order and energy crisis for the decline in investment, the Board of Investment, headed by Saleem Mandviwalla, has listed over half a dozen factors for the slump.

Last year, the BOI said contrary to the perception that law and order condition was the only obstacle in the way of attracting foreign investment, in reality, it was only one of many factors.

It attributed the continuous decrease in investment to global economic recession, inconsistent policies in the country, high cost of doing business, regulatory hurdles like lengthy processes, inadequate infrastructure and delayed response from ministries and provinces to investment proposals.

The BOI proposed a roadmap to address the challenges, but it remained only on papers and was not implemented, admitted Mandviwalla, who also served as finance minister in the last one month of the PPP government, which completed its term in mid-March.

Mandviwalla, who is still the BOI chairman, insisted that the overall economic slump had hit Pakistan’s economy hard.

When compared with regional peers, Pakistan is trailing badly. In India, the investment-to-GDP ratio is 35%, in Bangladesh 25.8%, Sri Lanka 33.3% and China, the world’s second largest economy, an impressive 46.8%.

A country like Afghanistan, which has borne the brunt of the ‘war on terror’, is also performing better than Pakistan as its investment ratio stands at 24.7%.

Published in The Express Tribune, May 9th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ