Fauji Fertilizer Bin Qasim (FFBL) – part of the largest fertiliser producers in the country – managed to turn around its fortunes after its plant only remained un-operational for a month in the January to March quarter, with higher sales driving profitability.

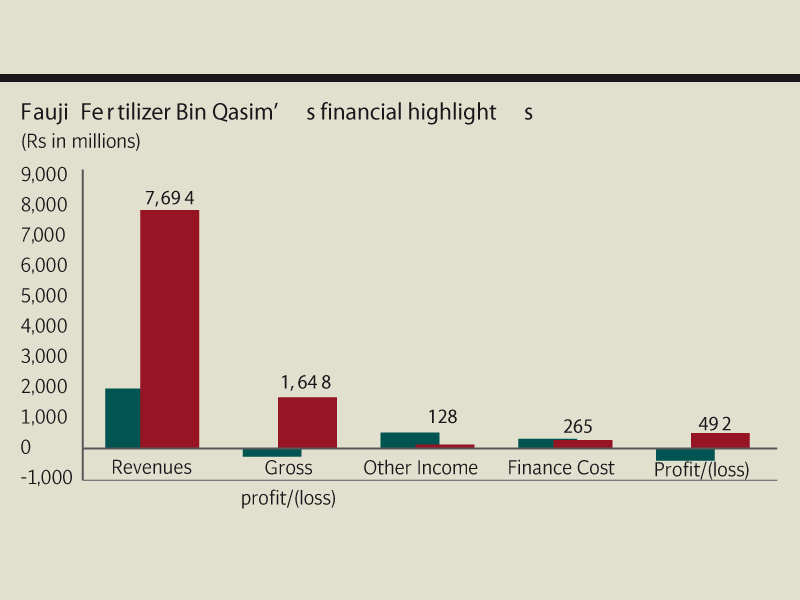

FFBL announced a net profit of Rs492 million, turning back on the profitability path, from a loss of Rs387 million in the corresponding quarter of 2012, according to notice sent to the Karachi Stock Exchange.

However, on a sequential basis, profit for the fertiliser manufacturer declined 78% from Rs2.208 billion.

FFBL’s earnings announcement was not accompanied with dividends, which the analysts believe is because of possible acquisition of Askari Bank by the Fauji consortium, a transaction with expected cash outflows of Rs4.3 billion for FFBL.

Urea manufacturing has been highly disturbed recently, marred by low gas supply and lost markets due the availability of cheaper imported urea, thus FFBL continued to focus more on DAP than urea when faced with scarce gas supply. In 2012, FFBL’s urea plant remained closed for 127 days.

In 2013 so far however, the gas situation is proving to be better than 2012 and curtailment varied between 20-40%. As a result, FFBL’s urea plant is currently operating at 70% utilisation alongside the DAP plant which is operating at full capacity, said a JS Global Capital research note.

Revenues for the fertiliser producer stood at Rs7.69 billion, clocking in four times higher compared to the corresponding quarter of last year’s revenues. “Higher revenues were expected on the back of much higher urea and DAP sales registered during the quarter, both of which were up seven times and four times respectively,” said Yousuf Rahman, analyst at Global Securities. In absolute terms, first quarter’s urea and DAP off-take stood at 25,000 tons and 77,000 tons respectively for FFBL.

FFBL posted gross profit of Rs1.65 billion in the January to March quarter, primarily driven by higher product sales, against a gross loss of Rs0.265 billion in the same period last year.

Rahman says that growth in volumetric sales was due to absence of standing water issues that occurred after recurring floods in 2010 and 2011 that dampened demand in the same period last year.

For FFBL, the main hurdle for achieving stellar results was a 45% decline in other income, which clocked in at Rs128 million due to a Rs48 million loss reported by Pakistan Maroc Phosphore (PMP) – a subsidiary in which the company holds a 25% stake.

Moreover, finance cost declined 13% to Rs265 million due to a 250 basis points cut in interest rates since August 2012. However, currency depreciation, which was calculated at 1% during the period under review, marginally offset the impact since purchase price of phosphoric acid increases for the company.

During Friday’s trading session at the Karachi Stock Exchange, FFBL’s stock shed Rs0.12 to close at Rs37.96.

Published in The Express Tribune, April 13th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

1730379446-0/WhatsApp-Image-2024-10-31-at-17-56-13-(1)1730379446-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ