Collusive activities: CCP nails Fauji Fertilizer, Engro Fertilizers with Rs8.6b fine

Investigation finds both companies unjustifiably increased prices of urea in tandem with each other.

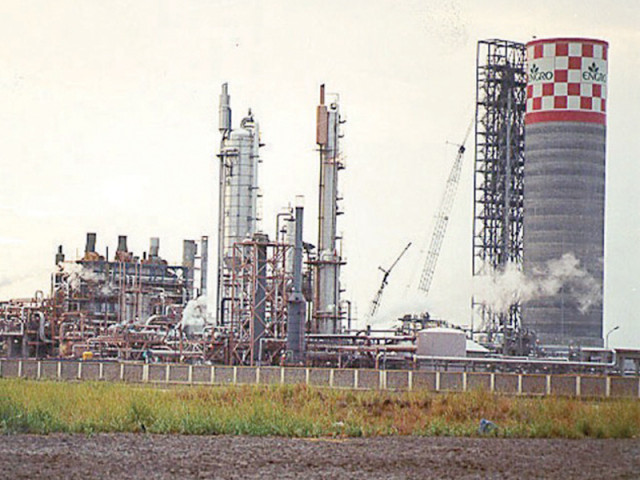

Both fertiliser producers enjoy a dominant position in the urea market. Fauji Fertilizer controls 48% of market share, while the market share of Engro Fertilizers is 26%. PHOTO: FILE

The country’s top antitrust watchdog has slapped a maximum collective penalty of Rs8.6 billion on Fauji Fertilizer and Engro Fertilizers – the two largest urea manufacturers in the country – after both entities were found involved in the “excessive pricing of urea”.

“Given the nature of [the] crime, the Competition Commission of Pakistan [CCP] has decided to impose the maximum penalty of 10% of the turnover on each company for unreasonable, unjustified and unfair increase in prices of urea in 2010,” CCP Chairperson Rahat Kaunain Hasan announced here on Tuesday. The chairperson said a Rs5.5 billion penalty had been imposed on Fauji Fertilizer and a Rs3.14 billion fine slapped on Engro Fertilizers. The fine was imposed by a two-member bench after almost a year and a half’s efforts in completing the investigation process.

The chairperson said both companies had raised the price of urea from Rs850 per 50 kilogramme bag to Rs1,580 in 2010 – an 86% increase – without proper justification. “The companies increased urea prices by 86% in just one year, while crop prices increased only 40-45% over a period of five years,” observed the chairperson.

“The bench felt restrained [in] that it could not impose a fine of more than 10% of turnover,” she added. Under the CCP Act, the maximum penalty that can be imposed by the commission is 10% of the errant company’s turnover, or Rs75 million, whichever is higher.

Hasan said the decision to impose the maximum penalty was taken after considering the importance of the agricultural sector to the economy, and the fact that these manufacturers had increased prices despite availing subsidies. She said the CCP has also advised the Securities and Exchange Commission of Pakistan to conduct a forensic cost audit of both the companies.

According to the bench’s findings, Rs77 billion were given in subsidies to the fertiliser industry over three years. In 2011 alone, Engro Fertilizers had received a subsidy of Rs4.5 billion, while Fauji Fertilizer had received approximately Rs11 billion in subsidies.

Both companies enjoy a dominant position in the urea market. Fauji Fertilizer controls 48% of market share, while the market share of Engro Fertilizers is 26%. The bench found that both had used their market power to initiate a price increase; with Engro initiating a price hike, which was followed by Fauji.

Hasan observed that Fauji did not have any justification for the increase: it is the single largest urea manufacturer in the country and should have behaved independently.

“In Fauji Fertilizer’s case, it is our considered view that – had there been competition – Fauji would not have increased its profits by more than 100% within one year,” Hasan said.

Both companies argued that they had increased prices to match the impact of gas curtailment on their input prices.

However, CCP’s findings show that Fauji’s plant was only slightly affected by gas curtailment, with impact in the range of 7-9%. Due to the price increase, Fauji Fertilizer’s gross profit margins increased from 43.6% or Rs19.6 billion in 2010, to 62.2% or Rs34.4 billion in 2011. Profits before interest and taxes, meanwhile, increased by a staggering 95%; from approximately Rs17.4 billion in 2010, to Rs33.95 billion in 2011. As per Fauji Fertilizer’s accounts, its rate of return on equity after tax comes out to 97% in 2011, up from 71.4% in 2010.

At the same time, Engro Fertilizers’ gross profit margin went up from 46.9% (Rs8.9 billion) to 53.37% (Rs16.7 billion), Hasan pointed out.

According to BMA Capital – an investment bank – the fines, if realised, will have an impact of Rs6.1 per share for Engro, and Rs3.9 per share for Fauji.

The CCP has so far imposed Rs17.1 billion in fines on errant corporate entities, but recoveries have remained at only Rs23 million as most parties have gone to court against the CCP’s decisions.

Published in The Express Tribune, April 3rd, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ