Weekly review: Politics drags KSE-100 index down 300 points

Domestic and global politics both contribute to market’s woes.

Domestic and global politics both contribute

to market’s woes.

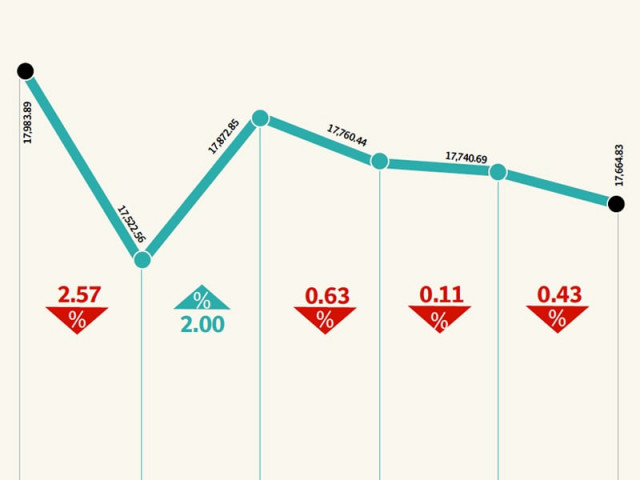

The stock market closed in the red for a second week in a row, as politics dominated proceedings at the bourse. The week ended March 15 saw the benchmark Karachi Stock Exchange (KSE)-100 index close down another 300 points (1.7%).

The market came under pressure from developments on both international and domestic fronts, as Pakistan and Iran began work on the Iran-Pakistan (IP) gas pipeline project and the National Assembly completed its tenure for the first time in history, with no consensus reached on the interim government setup.

The market reacted negatively to news of the inauguration of the IP pipeline on the opening day of the week. Widely viewed as a populist move by the outgoing government, the project may trigger economic sanctions from the United States.

The United States has fiercely opposed the project in the past, and it remains to be seen if it will indeed impose sanctions on Pakistan for the undertaking. Investors, too, showed their displeasure over the move, as the KSE-100 index plummeted 441 points (2.5%) on Monday.

The market recovered the following day, but came under further selling pressure as it became clear that the government and opposition were unlikely to reach a consensus regarding the interim setup as the National Assembly headed towards the completion of its tenure on March 16.

Both parties nominated three candidates each for the position of caretaker prime minister. Until the filing of this report, no consensus had been reached on the matter. The market slowly crawled down in subsequent sessions and towards the end of the week ended at 17,664 points.

On the macroeconomic front, the country’s foreign exchange reserves continued to dwindle and fell by $239 million during the week to close at $12.57 billion. Furthermore, remittances also declined 11% year-on-year in February and stood at $1.03 billion.

The country’s trade deficit for February 2013 was higher by 6.6% at $1.55 billion. However, for the first eight months of the current fiscal year, the trade gap narrowed by 10% to $13.2 billion.

On the industry front, the fertiliser sector remained under pressure as clarity was awaited on the issue of subsidised gas supply to Engro’s new plant under a new gas supply arrangement. However, towards the end of the week, it became clear that gas supplied to the plant will not be subsidised and Engro’s share price subsequently dropped by 6.5% to Rs119.61 by the end of the week.

Foreigners continued to put money into the stock market despite fears of US sanctions and a net inflow of $4 million was recorded.

Average daily volumes plummeted 27% to 173.76 million shares. Similarly, average daily values declined 14% to Rs6.08 billion. The market capitalisation of the KSE also declined 2.2% to reach Rs4.36 trillion by the end of the week.

Winners

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

TRG Pakistan

TRG Pakistan operates as an information technology company. The company provides business support and software services to companies. It manages call centres and offices in Pakistan and elsewhere throughout the world.

Losers

Pace (Pakistan)

Pace (Pakistan) develops real estate in both the residential and commercial sectors. The company develops and constructs shopping malls, supermarkets, and apartments.

Dawood Hercules

Dawood Hercules Corporation produces urea fertilisers. The company also produces anhydrous ammonia for manufacturers of soda ash, fructose, and other chemicals.

Pak Suzuki Motors

Pak Suzuki Motor Company manufactures, assembles and markets Suzuki cars, pickups, vans and 4X4 vehicles.

Published in The Express Tribune, March 17th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ