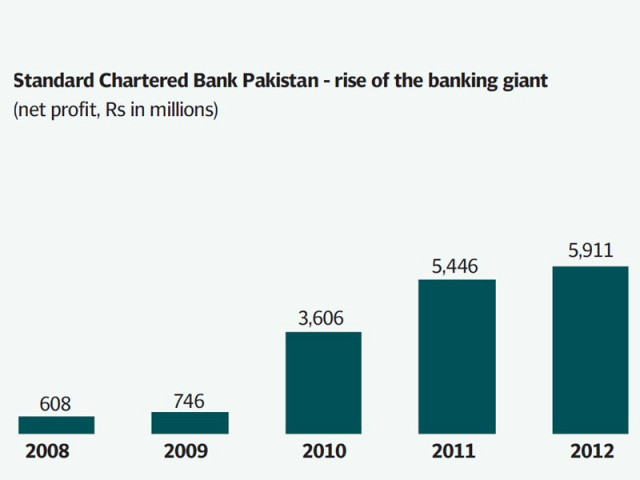

Corporate results: Despite flat revenue, Standard Chartered Bank’s profits rise

Lower provisioning for bad loans, controls on branch network expenses help growth.

The bank reported an 8.9% increase in net income, which reached Rs6 billion.

Few banks in Pakistan could make a flat top line yield an increase in profits, but Standard Chartered has managed to pull it off: for the year 2012, the bank reported an 8.9% increase in net income, which reached Rs6 billion.

But what shocked the market was not its respectable earnings announcement in a difficult year for the banks: it was the dividend. After having already paid out Rs0.75 per share earlier in the year, the bank announced that it will be paying another Rs1.25 per share, taking the total dividend to Rs2 per share. At this morning’s stock price of Rs12.50 per share, that translates into a 16% dividend yield.

Needless to say, the stock did not stay at those levels at hit the upper limit on its price increase (Re1 per share for stocks under Rs20), rising 8% for the day to close at Rs13.50 per share in Tuesday’s trading on the Karachi Stock Exchange.

The surprising dividend announcement aside, Standard Chartered had a reasonably good year in 2012. For the first nine months of the financial year ending December 31, 2012, the bank’s deposit base grew by about 13.4%, or only slightly less than the 13.8% increase for the banking industry as a whole. Yet it was able to make up for this slower growth by lowering its cost of deposits, which slipped to an average of around 4.7% for the year.

“We now have a lower cost of funds than United Bank,” said Naseer Hasan, the head of consumer banking at Standard Chartered Bank Pakistan, in an interview with The Express Tribune.

At least part of the bank’s increase in its deposit base came from inflows from multinational companies operating in Pakistan that had previously banked at other foreign banks that began to shut down their retail operations in the country. Citibank, for instance, announced that it would close its retail operations in Pakistan, and HSBC announced that it would sell off its Pakistan operations altogether to JS Bank.

“We did benefit to some degree from the closure of other foreign banks in Pakistan, but we have also benefited from creating a better customer experience for our clients,” said Raheel Ahmed, the regional head of consumer bank for Standard Chartered Bank’s operations in the Middle East, Pakistan and Africa.

A significant portion of the bank’s increased profits, however, came from the fact that – like much of the rest of the banking sector – its provisioning for bad loans came down as it shifted more and more of its lending portfolio into government securities. That shift towards government bonds dragged down the bank’s net interest income – the difference between the interest rate it charges its borrowers and the interest rate it pays out to depositors – by about 5% for the year.

As a result, total revenues remained flat at about Rs27.2 billion in 2012. Nonetheless, the combination of the bank’s declining provisioning expenses, and only minor increases in the cost of operating its branch network despite a major overhaul of many of them, resulted in the respectable profit increase for the bank.

reporting by farooq tirmizi

Published in The Express Tribune, March 6th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ