Pakistan Petroleum Limited (PPL), the country’s second-largest oil and gas explorer, reported a growth in profitability by 11% to Rs22.317 billion for the first half of the fiscal year 2012-13, mainly on the back of growth in its top-line, according to a copy of its financial results sent to the Karachi Stock Exchange.

And though the result was below market expectations, the board announced an interim dividend of Rs5 per share for the period, which will appease investors.

A significant increase in field expenditures and lower-than-estimated other income were the prime factors behind the lower earnings.

The growth in profitability in the period was primarily driven by stellar oil production (mainly from non-operated areas), coupled with higher well-head prices on uncapped fields, said BMA Capital analyst Muhammad Affan Ismail.

Net sales of the explorer climbed 12% to Rs50.7 billion on account of robust production from the Nashpa and Tal blocks, despite lower gas production. Moreover, 12% higher wellhead gas prices, higher Arab Light crude oil price, coupled with a 9% depreciation in average rupee prices during the period contributed to the double digit revenue growth.

A 13% increase in other income to Rs3.9 billion on account of healthy investment positions, coupled with a notable reduction in other expenses (down 18%) contributed significantly to earnings.

On the flipside, remarkably higher field expenditures of Rs13.7 billion on account of expanding exploration activity in PPL’s and joint-ventures’ blocks severely dented the bottom-line, forcing it to miss market’s expectations.

Topline Securities estimates that the explorer’s oil production averaged 9,400 barrels per day in the first half of fiscal 2013, against 7,900 barrels per day in the corresponding period of the previous year – up 19%. This growth in production was more than enough to augment pressure brought on by an 8% decline in gas sales.

PPL has recently announced oil and gas finds at Nashpa-3, Mamikhel-2, Manzalai-9 and Makori East-2, a combined oil and gas production potential of 10,400 barrels and 83 million cubic feet of gas per day. Adjusting for PPL’s stake, these finds provided 32% and 2% upside to the explorer’s volumes respectively.

Outlook

Beyond the first half of fiscal 2013, PPL will carry its profitability momentum through robust volumetric growth, driven by full wing production from Nashpa and Tal blocks, steady oil prices which are already up 4%, and further depreciation of the rupee. However, above expected decline in the Sui field and a probable secondary offering by the government remain key downside risks.

The government intends to offload 2.5% of its shareholding, with a possibility of an additional 2.5% as a green shoe option, where it can sell more shares if the offering is oversubscribed.

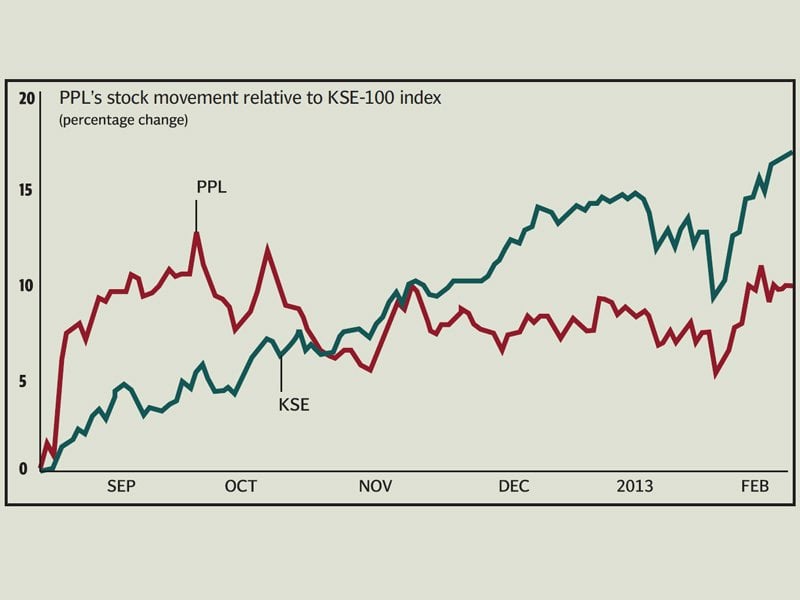

According to analysts and the data on the Karachi Stock Exchange’s website, PPL’s stock trades at price-earnings ratio of 6.1 times, at a steep discount to the 6.9 times at which the sector stands at. The stock offers an upside of 31% from its previous close of Rs179 per share, and offers a dividend yield of 6%, once the market realises the true potential of the scrip, according to a Global Securities research note.

Published in The Express Tribune, February 5th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS (2)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732003896-0/Zendaya-(1)1732003896-0-165x106.webp)

1731914690-0/trump-(26)1731914690-0-165x106.webp)

1732003946-0/BeFunky-collage-(70)1732003946-0-165x106.webp)

1731749026-0/Copy-of-Untitled-(3)1731749026-0-270x192.webp)

Nashpa- Located at Karak, producing a huge amount of Oil and Gas on daily basis, but still my city has no proper gas facility, no Scholar ships or Quotas for the students their, no construction of any Technical college, No Jobs for the local residents and the list goes on.... :(

Almost all listed companies are posting record profits, consumption of consumer goods is at record levels and imports of the same continue to rise but Pakistanis continue to lament about recession. I wish Pakistanis do indeed get a taste of what recession tastes like. This is the most thankless country if there ever was one.