Lucky Cement on a hot streak: earns Rs4.3b in first half of fiscal 2013

Strong local demand, better margins boost bottom-line.

The astounding boost was driven solely by selling prices, which surged 13% to Rs465 per bag in the south zone and 8% to Rs438 in the north.

Lucky Cement profits solidified at Rs4.29 billion in the first half of the fiscal year 2012-13, up 42.15% from Rs3.018 billion in the corresponding period of last year, according to a copy of the results sent to the Karachi Stock Exchange.

The astounding boost was driven solely by selling prices, which surged 13% to Rs465 per bag in the south zone and 8% to Rs438 in the north. Additionally, surging other income and declining financial charges supported the bottom-line, said a BMA Capital research note.

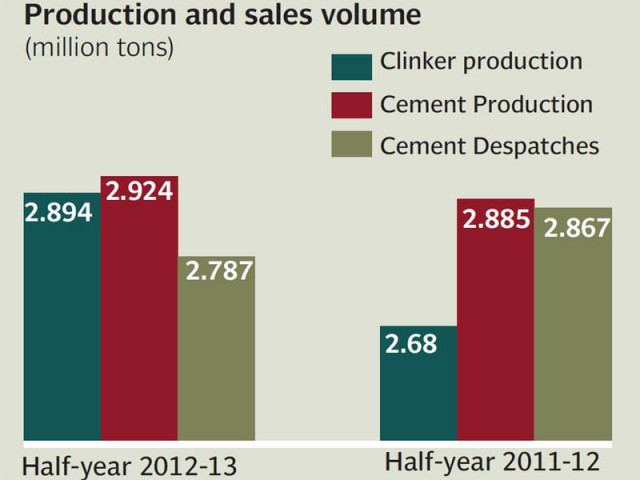

Despite a 3% decline in sales volume, revenue clocked in at Rs17.5 billion, up 14% against Rs15.4 billion in the corresponding period last year, mainly due to climbing cement prices.

Strong local demand negated the effect of decreasing exports for Lucky Cement in the half. Lucky Cement’s local sales registered a growth of 5.5% to 1.77 million tons, whereas cement exported by the company declined 14.6% to 1.01 million tons primarily because of the lower demand from the Gulf and African countries.

Gross margins continued its upward trend with a growth of 6.1 percentage points to settle at 44.1% in the period – the highest in the industry – as international coal prices registered a decrease of 4%.

The cement producer also managed to cut back on its finance costs to Rs66 million by reducing its long-term debt leverage. Lucky Cement also managed to boost its other income by supplying electricity to Hyderabad Electric Supply Company to Rs153 million against a meagre Rs0.77 million in 2012’s corresponding period.

During the period, the company relied on short term borrowings, which amounted to Rs2.6 billion, whereas the company had zero short-term borrowings in June 2012. According to a Topline Securities’ analyst note, the company also recorded a long-term investment of Rs5.6 billion after successfully setting up its subsidiary – Lucky Holdings – to acquire a 75% stake in ICI Pakistan.

Despite the strong performance, Lucky Cement lost 2% of its footing in the cement industry as it market share went down to 17% for the half-year 2012-13.

Published in The Express Tribune, January 29th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ