Corporate results: Fauji Fertilizer Company earns Rs20.8b in 2012

Announces cash payout of Rs5 per share, taking cumulative payout to Rs15.5.

Despite flat sales volume, revenues managed to jump 35% to Rs74.322 billion with climbing urea prices being the major revenue driver.

Fauji Fertilizer Company (FFC) – one of the companies largely unaffected by the gas supply issue – announced a profit of Rs20.839 billion for 2012, down 7% compared to previous year’s profit of Rs22.492 billion.

FFC enjoys benefits of stable gas supply from Mari network, a huge competitive advantage over manufacturers operating on the Sui-based network.

Nonetheless in a meeting held in Karachi, the fertiliser producer’s board of directors announced a final cash payout of Rs5 per share, taking the cumulative return on its shareholder’s investment to Rs15.5 per share.

FFC’s volumetric sales remained subdued throughout the year, clocking in at 2.4 million tons, according to a BMA Capital flash note. Despite flat sales volume, revenues managed to jump 35% to Rs74.322 billion with climbing urea prices being the major revenue driver. Arif Habib Corporation estimates urea prices went up 17% year-on-year where the average price was calculated to be Rs1,706 per bag.

“Moreover, the company also managed to sell imported di-ammonia phosphate (DAP) at improved prices which helped FFC’s revenues figures when urea off-take was substantially lower,” reported Muhammad Sarfraz Abbasi, analyst at Summit Capital. FFC flooded the market with 65,000 tons of imported DAP in 2012 against nil in 2011.

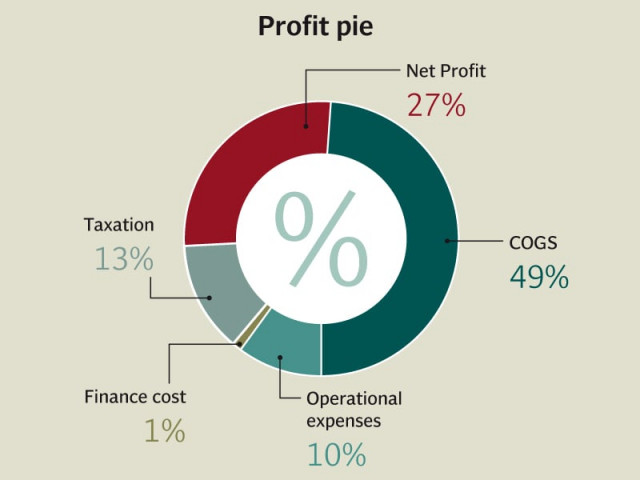

Impact of revenue growth was limited by a whopping increase of 84% in the cost of sales due to the company’s dampened ability to absorb fixed cost as a consequence of lower production levels. The cost of sales rose 1.84 times in comparison to 1.35 times growth in sales.

Gross margins squeezed 14 percentage points to 48% in 2012 as the gas infrastructure development cess imposed in January 2012 was not passed on amid continuous demand-side pressures. Limited operating margins coupled with 27% higher distribution expenses, owing to higher transportation costs and salaries, resulted in operating profits to grow by a mere 2% to Rs30.4 billion.

However, all things aside, FFC’s Achilles heel turned out to be the strong upsurge in financial charges along with absence of dividend income. Financial charges were up 27%, touching a billion due to higher leverage as the fertiliser producer borrowed to finance pending inventories piling up because of lower urea off-take. Other income declined 36% to Rs4.268 million, the drop is attributed to absence of dividend income from its subsidiary Fauji Fertilizer Bin Qasim Limited.

Going forward

Analysts expect FFC to recover in 2013 as international urea prices rebound. Moreover, considering Pakistan’s current economic position, the government will have to rely on domestic fertiliser rather than imports to feed the agriculture sector as the country scrambles to save foreign exchange currently at critical levels.

The Fauji Group is interested in acquiring a 51% stake in Askari Bank, and the transaction is estimated to range between Rs13.5 billion and Rs14.7 billion. Assuming 50% contribution of FFC in the takeover, fertiliser producer’s cash outlay can range from Rs6.75 billion to Rs7.35 billion, which may affect future payouts.

The stock closed down Rs1.17 at Rs118.59 during yesterday’s session at the Karachi Stock Exchange as absence of a bonus issue hurt sentiments towards the scrip. However, the stock can prove to be lucrative for defensive investors who seek high-yielding opportunities to redeploy cash.

Published in The Express Tribune, January 24th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ