Weekly Review: Political uncertainty keeps bourse at bay

Volumes decline sharply ahead of the ‘million-man’ march in the coming week.

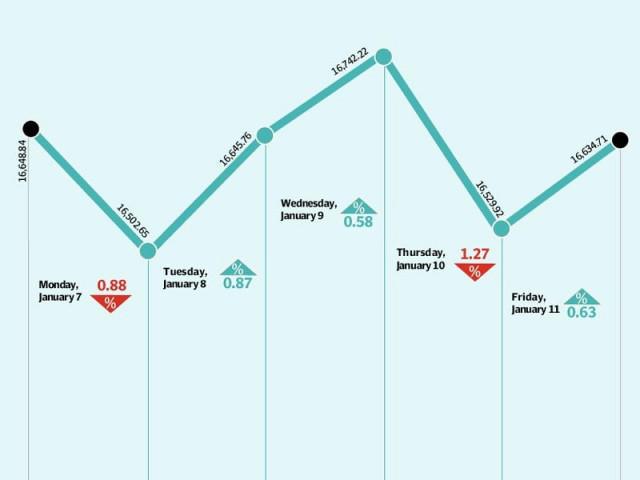

The benchmark KSE-100 index closed flat, down 14 points (0.1%) during the week.

The stock market witnessed a dull week and remained range-bound due to heightened political uncertainty in the country. The benchmark KSE-100 index closed flat, down 14 points (0.1%) during the week.

Investors chose to be cautious throughout the week, with several parties making statements about their participation in Dr Tahirul Qadri’s ‘million-man’ march, which intends to bring a change in the government. The march is planned to take place on January 14 and has created friction between the government and its allies.

While most political parties chose to abstain from the march, the MQM, which is also a government ally, initially announced that it would participate in the rally. However, a day later it backtracked on its statement and decided not to participate. Investors welcomed the decision, which led to a small relief rally on the final trading session of the week.

The law and order situation also played on investor’s minds as a series of bomb blasts took place across the country, which resulted in a heavy loss of life. Furthermore, tensions erupted at the line of control with India, as border skirmishes led to the death of several soldiers on both sides of the fence.

However, all news was not bad news, as foreigners again turned net buyers at the bourse. With the earnings season set to get in flow in the coming week, foreigners picked up equities at attractive valuations and were net buyers of equity worth $8.4 million.

Macro numbers were mixed, with the highlight being the double-digit growth in remittances for the first six months of the current fiscal year. Remittances grew 12.5% year-on-year and stood at $7.12 billion for the first half of the fiscal year 2012-13.

The figures were dampened by the declining forex reserves of the country, which dropped $249 million on account of repayments to the International Monetary Fund. The government is now discussing a second bailout package from the IMF, as the country’s forex reserves continue to drop to critical levels.

The cement sector was again in the limelight as cement sales surged 5.9% year-on-year during December 2012 and as a result, activity was witnessed in the sector, with Fauji Cement and Lucky Cement being the main beneficiaries.

The banking and power sectors also witnessed activity as investors expect good payouts during the earnings season. While the fertiliser sector also made news with Fauji Fertilizer Bin Qasim announced a decrease in earnings by 60% during 2012.

The cautious approach of investors was reflected in the sharp drop in average daily volumes, which plummeted 35% and stood at 96 million shares per day as compared to 148 million shares in the previous week.

Average daily values, however, dropped only by 17.5% and stood at Rs2.81 billion, as most of the foreign investment took place in blue-chip stocks. The market capitalisation of the KSE dropped 0.1% to Rs4.17 trillion by the end of the week.

Winners

Fauji Cement

Fauji Cement Company Limited manufactures and sells cement.

Askari Bank

Askari Commercial Bank Limited provides commercial banking services. The bank has branches in Pakistan, Azad Jammu and Kashmir and Bahrain.

Pakistan Tobacco

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Losers

Grays of Cambridge

Grays of Cambridge (Pakistan) is a holding company. The company, through its subsidiaries, manufactures and exports sporting goods, specialising in hockey sticks.

JDW Sugar

JDW Sugar Mills produces and sells crystalline sugar. The company is located in Rahimyar Khan, and was formerly named United Sugar Mills Limited.

Abbott Laboratories

Abbott Laboratories (Pakistan) manufactures, imports, and markets research-based pharmaceutical, nutritional, diagnostic, hospital, and consumer products.

Published in The Express Tribune, January 13th, 2013.

Like Business on Facebook to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ