Market rises 1.1% as KSE and SECP showdown drags on

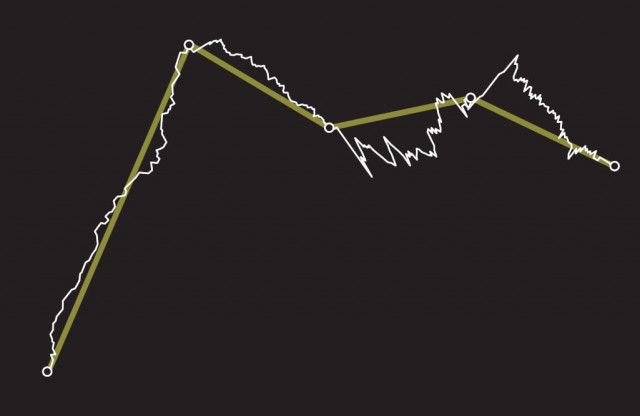

Activity remained subdued in the country’s bourses during the week ended September 3.

The market started off the week on a negative note, declining by almost 1 per cent before the SECP called an emergency meeting between itself and KSE Board to discuss and resolve the note of dissent on the modalities of the product, issued by KSE Chairman Zubyr Soomro.

The market immediately reacted positively to the announcement and Tuesday witnessed the biggest gain of the KSE-100 during the year 2010 as the index climbed by 3.12 per cent. But the meeting itself was a seperate story altogether.

It is believed that the SECP is adamant that the KSE Board revise the draft paper of the margin product and address the concerns of Soomro, who has been appointed as head of the KSE Board by none other than the apex reglulator of the index, the SECP.

The KSE ckhairman’s concerns centre around two issues. The first is margin financing for individual investors and the role it might play in promoting money laundering. The second is regarding default proceedings of the product, where he insists that the broker should default and not the client.

The SECP’s stance resulted in a deadlock between itself and the broker-dominated Board of the Exchange. Although more talks are scheduled, the index declined by nearly 1.5 per cent in the final three days of the week, as investors showed their displeasure at the delay in the introduction of the margin product.

To complicate matters further, the KSE Board members met on Thursday and resolved to get rid of the rule that the chairman of the KSE board be appointed by the SECP, to ensure smooth functioning of the exchange. The news did little to improve investor sentiment as it sets the KSE and the SECP on a collision course.

Macro data such as the International Monetary Fund’s announcement of an emergency loan of $450m and the World Bank upping its pledged loan to $1b from $900m had a negligible impact on the proceedings at the bourse.

Investor sentiments remained weak throughout the week, but average daily volumes increased by 7 per cent, to 50m shares, as a result of the relatively high activity on Tuesday when 81m shares were traded. Average daily value, also shot up by 42.7 per cent as selective buying was witnessed in blue-chip stocks in which foreign buying was anticipated.

Total market capitalization of the KSE remained improved by 1 per cent to Rs2.71 trillion by the end of the week. Net foreign buying stood at $8m while locals individuals were sellers of $7.3m worth of stocks during the week.

What to expect?

A swift resolution of the margin product issue will be essential for a short-term recovery of the market as we move forward. The market currently is almost where it started the year from and many scrips are trading at very attractive valuations, providing a great opportunity for investors to engage in buying.

Investors have been overlooking market fundamentals and externalities like the KSE-SECP dispute have been dictating the direction of the market for the past few months. A quick resolution of the issue will surely provide a big boost to the market.

Till then, the market is likely to keep struggling and near-term direction will be guided by the IMF review of the loan programme and foreign inflows into the country.

Published in The Express Tribune, September 5th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ