PM calls for widening tax base

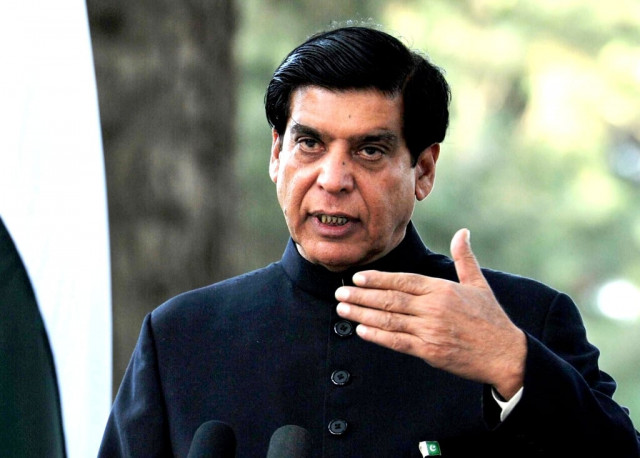

PM Ashraf says taxation structure aimed at enhancing revenues should be streamlined to promote voluntary tax payment.

PM calls for widening tax base

Presiding over a meeting of Federal Board of Revenue (FBR) at the PM House on Monday, the prime minister said that the self-respect of tax-payers should be protected and a taxation structure, aimed at enhancing revenues, should be streamlined to promote a culture of voluntary tax payment.

Chairman FBR Ali Arshad Hakeem informed the meeting that tax collection has doubled since 2008 from Rs1 trillion to Rs2 trillion this year.

He added that there was a recorded increase of 22% in the tax revenues this year as compared to the last year.

The meeting was also informed that there were 805,000 registered tax payers of which 260,000 people paid taxes consecutively for three years.

The prime minister said that a large segment of Pakistan’s economy was informal, depriving the national exchequer of its due share and acting as a hindrance in the economic planning and development. The menace of capital flight to tax havens has deprived the country of its true potential for development and progress, he maintained.

PM Ashraf added that the demand for cars, luxury goods and housing reflected the availability of wealth in the country. Unfortunately, the tax base is not commensurate to this phenomenon, he regretted.

The prime minister urged the FBR to plug the leakage of taxes and bring the elite groups of the society into the tax net.

The meeting was attended by Finance Minister Dr Abdul Hafeez Shaikh, Defence Minister Syed Naveed Qamar, Minister for Religious Affairs Syed Khursheed Ahmed, Law Minister Farooq H Naek, Deputy Chairman Planning Commission Dr Nadeemul Haq and other senior officials.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ