Weekly review: Bulls stay afloat as market continues to celebrate at peak levels

Sector-specific activity reduces effect of adverse macroeconomic developments, political concerns.

In a shortened week, bullish sentiments continued to push past historic highs, driven by positive sector-specific news. Adverse macroeconomic developments and political concerns were unable to hurt the upward momentum.

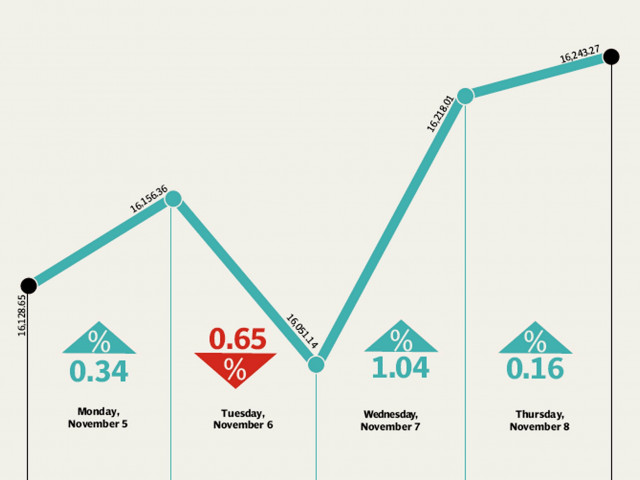

The benchmark index managed to close at 16,243.27 points, up 0.9% from previous week’s 16,101.55. The market was able to extend its bullish momentum during October 2012, bringing current year to date gains to a robust 40%, making Pakistan one of the best performing equity markets in the world, says an AKD Research note.

Investors remained focus on brewing developments over political (military-judiciary clashes, Asghar Khan Case and Swiss letter) and international (US elections) political landscape.

Weekly gains were trimmed as the Chief of Army Staff General Ashfaq Pervez Kayani warned, in a veiled challenge to the Supreme Court, that any efforts to undermine the military and “draw a wedge” between it and the country’s citizens will not be tolerated. However, investors remained determined due to positive sector-specific developments coupled with foreign interest in the market. Foreign investment inflow clocked in at $15.7 million, which included a one-off inflow in the form of Pakistan International Container Terminal sale to Manila-based port operator – International Container Terminal Services Incorporated.

Budget deficit soared to Rs282 billion in first quarter of fiscal 2013; the government’s fiscal deficit was recorded at 1.2% of the gross domestic product (GDP), which was lower compared to 1.25% of GDP in the corresponding quarter of last year, says a KASB Securities research note.

On the other hand, key news flows driving sentiments included the street talk in resumption of gas supply to fertiliser plants on the Sui Northern Gas Pipelines network. The Economic Coordination shelved the 300,000 tons urea import plan but did not gave a concrete decision on approval of 75 million cubic feet per day of gas supply during the winter season, says a JS Global Capital note. The news attracted positive sentiments on the fertiliser sector. Engro outperformed the market by 4.8% over the week. The SNGPL network includes Pakarab Fertilizer, Engro Enven, Agritech Limited and Dawood Hercules fertiliser plants.

Moreover, the Lahore High Court extended the hearing on Pakistan Telecommunication Company’s international clearing house (ICH) to November 14, 2012, which adversely affected the telecom giant’s stock price; however the stock managed to close in black later.

Engro Foods was the star performer this week over rumours of Saudi Arabia based dairy producer – Al Marai – buying a stake in the company.

United Bank was able to outperform the bourse by 5.6% on the back of a one-off derivatives gain combined with surging international deposits.

Outlook

Since result-related excitement has subsided, the market seeks new triggers to sustain momentum. Verdict on the ICH case can make or break gains in the telecom sector. US’s terms of engagement with Pakistan are expected to remain unchanged as Barack Obama holds the office for the second-term.

Pakistan will pay back $600 million to the International Monetary Fund this month, forcing rupee to depreciate which will likely translate into volatility on the front.

Winners

Thal Limited

Thal Limited manufactures jute goods, engineering goods, papersack and laminated sheets. The jute operations at Muzaffargarh, engineering operations at Karachi, papersack operations at Hub and Gadoon and laminate operations at Hub.

Engro Foods

Engro Foods Limited manufactures, processes, and sells food products primarily in Pakistan and North America. It provides dairy products, juices and nectars, ice cream, meat, and frozen desserts. The company also owns and operates a dairy farm.

JS Growth Fund

JS Growth Fund is a closed-end fund incorporated in Pakistan. The fund’s objective is to provide capital appreciation and income. The fund invests in a diversified portfolio of equity securities listed in the Karachi Stock Exchange.

Losers

National Foods

National Foods Limited operates as a food company in Pakistan and internationally. The company engages in the manufacture and sale of spices, pickles, ketchup, jams, jellies, sauces, cooking pastes, rice, salt, juices, and ready-to-eat meals.

Murree Brewery

Murree Brewery Company Limited manufactures Pakistan-made foreign liquor (PMFL) including alcoholic beer, non-alcoholic beer, non-alcoholic products, which include juices in tetra packs in Rawalpindi and food products, juices, glass bottles and jars in Hattar.

Pace (Pakistan)

Pace is part of a larger conglomerate, the First Capital Group, which owns and operates a number of businesses in the financial services, real estate development, media and telecom sectors in the country and abroad.

Published in The Express Tribune, November 11th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ