Corporate results: DG Khan Cement profits shoot up from millions to billions

Profits swelled 4.5 times to Rs1.44b from Rs318m, during first quarter of fiscal 2013.

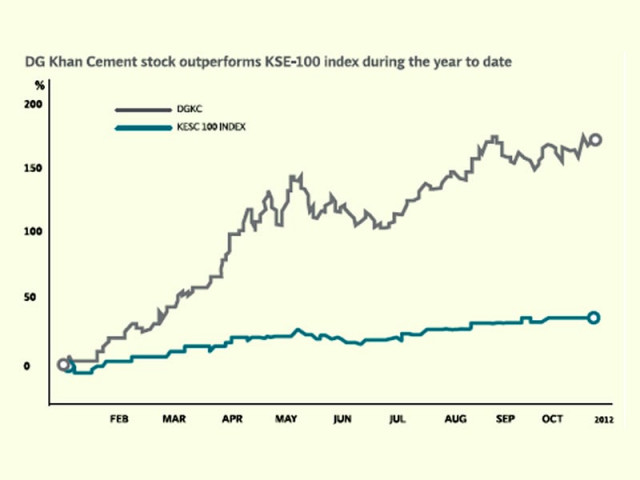

In a twist of fate, DG Khan Cement was able to switch its profitability from millions to billions – bouncing back into familiar territory for the cement producer and solidifying its position in the sector.

The company’s results for the quarter were mostly in line with analyst expectations, who say that primary factors behind enhanced earnings were higher revenues, better margins, increased income from its associates and lower effective tax rate.

Profit for the country’s second-largest cement manufacturer swelled 4.5 times or 353% to Rs1.44 billion in the first quarter of the fiscal year 2012-13 from Rs317.8 million in the corresponding quarter of the previous year, according to unconsolidated results sent to the Karachi Stock Exchange on Wednesday.

Revenues enhanced by 15.5% to Rs5.87 billion in the period under review. The notable uptick in sales was attributed to hefty inflation in cement prices, up 11% from a year earlier, while increasing dispatched further added to the revenue, said Muhammad Affan Ismail, analyst at BMA Capital.

Local dispatches grew 2.8% to 7.7 million tons in the first quarter of the fiscal year 2012-13 from 7.5 million tons in the corresponding quarter of the previous year, data from All Pakistan Cement Manufacturers Association shows.

Similarly, gross margins spiked up by 758 basis points to settle at 37.7% on the back of higher prices and new cost rationalisation measures from trial run of its energy-efficient Waste Heat Recovery and Refuse Derived Fuel plant during the period. Moreover, apart from robust retention level, considerable dip in coal prices, down 22% to $82.32 per ton, supported uptick in margins. Resultantly, gross profits climbed to Rs2.21 billion.

Meanwhile, ‘other income’ contributed 25% to total earnings, increasing 36% over the corresponding quarter to Rs356 million, owing to dividend income from MCB Bank – associate company. Other associates include Nishat Mills and Nish Chunian among others.

The bottom-line was also supported by the decline in financial charges by a sharp 33% to Rs303 million as against Rs449 million. Cement manufacturers were among the most highly leverage sectors in the economy, and with successive interest rates cuts by the State Bank of Pakistan by over 200 basis points over the last quarter, the company was able to substantially cut down its finance costs.

The healthy earnings were also the result of a one-off tax reversal – which generally arises when tax relief is provided in advance of an expense – the company incorporated an effective tax rate of 5% against 43% charged in the corresponding quarter of the preceding year.

The year ahead

Higher sales due to ongoing work on the Diamer Bhasha dam, reconstruction activities in flood affected areas, higher retention prices and lower interest rates have remained the key factors driving stronger earnings for cement producers. However, going forward, analysts predict a slowdown in growth in sales or profits, as prices are forecasted to rise exceptionally higher – putting adverse pressure on local demand. However, utilisation of the country’s coal resources in powering cement plants remains a strong factor which can ensure stability in earnings, in case of further pressure on prices in the international market.

Published in The Express Tribune, October 25th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ