Weekly Review: Bourse hovers around historic high over monetary easing

Investors flock to propel the market over positive news flow this week.

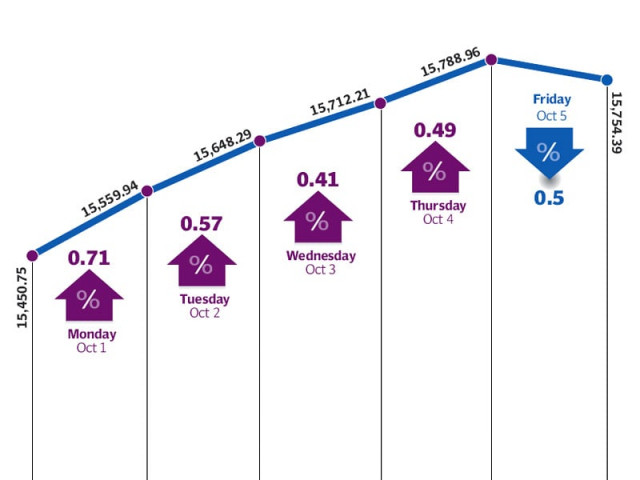

The benchmark KSE-100 index closed up 2% during the week at 15,754.39 points. The local bourse breached its previous record high of 15,676 points, achieved in April 2008, closing above the 15,700 point level.

Positive news flows, full-year results and anticipation of monetary easing by the State Bank of Pakistan kept the market moving up. Foreign investors also jumped on the bull-bandwagon as week’s inflows clocked in $12.2 million, according to the KASB weekly analysis report.

Trading volumes witnessed a 41% increase to 134 million shares against 95 million shares previous week.

According to the data released by the Pakistan Bureau of Statistics, inflation for September 2012 clocked in at 8.8% year-on-year, which cemented the expectations for further interest rate cuts coupled with decline in Treasury bill yields. The figure was the lowest inflation number since December 2009, driving the central bank to cite 9.5% inflation target for the year as more achievable and slash the discount rate by 50bps to 10%, according JS Global Capital analyst Furqan Ayub.

In corporate and sector-specific news, leveraged companies and dividend-yielding stocks remained in the limelight with Nishat Chunian and Nishat Chunian Power announcing healthy payouts of Rs2 per share or 20%, along with their corporate results for the fiscal year 2011-12.

On the other hand, DG Khan Cement and Nishat Mills unveiled plans to invest Rs500 million and Rs600 million respectively to establish a dairy farm – Nishat Dairy (associated company).

As for the index-heavyweight oil and gas sector, successful drilling operation on Mamikhel, smooth operation at Maramzai prodived the momentum Pakistan Oilfields and others to close in positive.

Banking sector however witnessed profit taking as investors believed that decline in interest rate will hurt their margins, said Samar Iqbal, equity dealer at Topline Securities.

Cement sector also witnessed brisk activity as expectations of rate cut as well as soft coal price outlook generated interest in the sector.

Fauji Fertilizer Bin Qasim raised DAP prices by Rs100 per bag and the Economic Coordination Committee allowed import of 200,000 tons of urea for the upcoming Rabi season which will add to the surplus in the local market and dent the fertiliser manufacturers’ pricing power.

Outlook

The bourse is expected to be range-bound going ahead as the cut in interest rates announced by the central bank on Friday of 50 basis points was lower than expectations. Moreover, with the index hovering near the psychological level of 16,000 points, it will be interesting to see how choppy waters are navigated. Trading volumes may dry up without immediate lack of triggers; however it is not expected for the lull to continue as quarterly corporate results are just around the corner.

Winners of the week

Attock Refinery

Attock Refinery Limited (ARL) refines crude oil and produces a range

of petroleum products including liquefied petroleum gas and high

speed diesel. The company is a subsidiary of The Attock Oil Company Limited.

Murree Brewery

Murree Brewery Company Limited manufactures Pakistan-made foreign liquor (PMFL) including alcoholic beer, non-alcoholic beer, non-alcoholic products, which includes juices in tetra packs in Rawalpindi and food products, juices, glass bottles and jars in Hattar.

Nestle Pakistan Limited

The company is engaged in manufacturing, processing and sale of food products (dairy, confectionary, culinary, coffee, beverages, infant nutrition and drinking water). The segments of the company include milk and nutrition products, and beverages.

Losers of the week

KESC

Karachi Electric Supply Company (KESC) is engaged in the generation, transmission and distribution of electricity to industrial, commercial, agricultural and residential consumers. It covers an area of 6,000 square kilometres.

SilkBank Limited

SilkBank Limited provides various banking services in Pakistan. The company operates in four segments: corporate finance, trading and sales, retail banking, and commercial banking.

Pak Services

Pakistan Services Limited is primarily engaged in the hotel business. It owns and operates the chain of Pearl Continental Hotels in the country and Azad Jammu and Kashmir. Its subsidiaries include rent-a-car, tour packages and project management.

Published in The Express Tribune, October 7th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ