Weekly Review: Insipid week despite strong corporate results

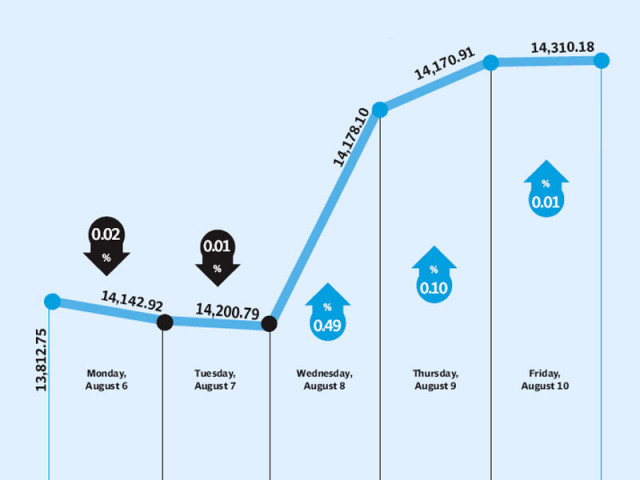

KSE’s benchmark 100-share index gains 0.58%.

Investor interest at the bourse remained subdued as all eyes were on the week-end monetary policy statement.

In the relatively lacklustre week, the benchmark KSE-100 share index increased 0.58% to at the 14,761 level on a weekly basis.

Volumes plummeted by 28% to 60 million shares amid monetary policy anticipation and NRO case proceedings.

The lacklustre performance was somewhat surprising, considering that expectations of potential easing in the upcoming monetary policy continued to gain traction, according to KASB Securities research note.

In addition, the market only selectively responded to a raft of blue chip companies – MCB Bank, Oil and Gas Development Company, Pakistan State Oil, Indus Motor and Habib Bank – springing positive surprises in their results for the June quarter, and also the market did not elicit much excitement to the consistently positive foreign inflows of $5.96 million, up 167% during the week, adds the report.

Karachi Electric Supply Company was the highest gainer of the week following reports that it switched to a profit after six years of loss. The electric supplier posted net profit of Rs2.62 billion, more than the total amount the company made in the last ten financial years, in fiscal 2012 compared with loss of Rs9.4 billion in the same period a year ago.

Part of the drag could be attributed to noisy politics where following the striking down of the controversial contempt of court bill last Friday evening, the Supreme Court issued a show cause notice to the Prime Minister for contempt of court and summoned him to court on 27th August.

In major economic development, the Economic Coordination Committee approved import of 0.3 million tons of urea and held urea prices. This revived sentiment towards urea producers and took Fauji Fertilizer Company and Engro shares up 0.2% and 3.4% respectively.

Outlook

The key driver for the upcoming shortened week is likely to be positive following the 150 basis points cut during the weekend in the monetary policy statement.

Beating market expectation, the State Bank of Pakistan on Friday evening cut the policy rate by 150 basis points to 10.5 per cent.

Meanwhile participants are likely to adjust positions ahead of the six day break. Post-Eid focus is likely to revolve around the premier’s appearance in court and political consequences of the same.

Published in The Express Tribune, August 12th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ