Corporate results: PSO makes record sales, but takes home less profit

Volatile oil prices and the rupee falling to a record low dent profits.

Corporate results: PSO makes record sales, but takes home less profit

The company was a victim to the volatile oil prices and the rupee falling to a record low against the dollar, according to analysts.

Due to 24% decline in crude oil prices, the prices of the highest selling products furnace oil and high speed diesel fell by 11.8% and 11.2%, respectively, says a notice issued by Arif Habib Research.

These losses alone hit the final quarter earnings by Rs2.4 billion, BMA Capital analyst told The Express Tribune.

Moreover, better than expected payout primarily by stock dividend of 20% cherished market sentiment.

The company also announced final cash dividend of Rs2.5 per share, taking the total cash payout to Rs5.5 per share for financial year 2012.

Lower than expected inventory and FX losses seem to have made company to post above expected results

The payout and dividend announcement shot the stock value up 3.5% or Rs8.54 to close at Rs250.31.

Revenues surge to all-time high

Despite a slight slip in volumes, revenues crossed Rs1 trillion due to higher product prices of other petroleum products.

PSO became Pakistan’s first company to have revenues in the trillion territory.

Revenues jumped 23% to Rs1.2 trillion for the year ended June 30, 2012 compared with Rs975 billion in fiscal 2011.

The outgoing year was a slow one for PSO as volumes failed to provide any catalyst to the bottom-line amid drastic fall in export sales of jet fuel and furnace oil, said BMA Capital analyst Furqan Punjani.

However, the company managed to increase its market share in cash-easy products like petrol.

During fiscal 2012, the cumulative product sales fell by 4% to 13.0 million tons compared with 13.6 million tons in same period last year. Despite improvement in margins lately, furnace oil sales fell by 8% due to non-payments by IPPs and remained the biggest concerns.

Capitalising on serious CNG shortages, PSO managed to increase both exposure and supplies of cash-easy product petrol, showing a marked volumetric improvement of 22% to 1.38 million tons.

The board members in its meeting expressed concerns over the rising balance of receivables which stand at Rs237 billion as on August 9, 2012, the company said in a press statement on Thursday. “This has created an acute financial crunch as the company struggles to meet its international and local obligations. It was noted that this situation is not sustainable and presents a significant risk to PSO’s ability to ensure availability of petroleum products,” says the statement.

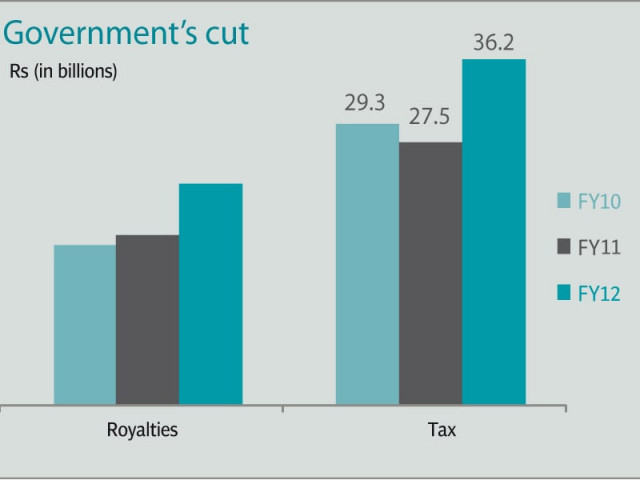

Earnings were also dented due to a deferred tax adjustment made in the previous year amounting to Rs2.29 billion, which resulted from the reinstatement of the rate of turnover tax by the tax authorities.

Further, the financial cost resulting from the accumulation of all-time high receivables continue to constrain both profitability and liquidity of PSO, adds the statement.

Published in The Express Tribune, August 10th, 2012.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ